This player’s pipeline should keep growth going over the long run.

When you think of biotech companies, you may think of exciting young players that haven’t yet commercialized a product. Those exist and, in some cases, make excellent investments. But you also might consider picking up a biotech player that has proven itself and today offers you both innovation and growth.

This type of company is one to hold onto for the long term as it’s already generating revenue but has the research and development strengths to continue building a portfolio of game-changing products. With this in mind, let’s check out one no-brainer biotech stock to buy today and never sell.

Image source: Getty Images.

A biotech company generating billions

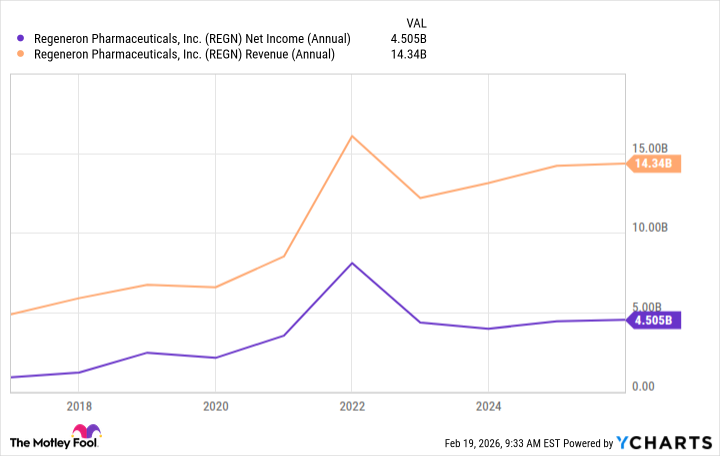

The company I’m talking to has been around for more than 35 years and sells a number of products, from treatments for inflammation to those for cholesterol and eye disease. This player is Regeneron (REGN 0.23%), a biotech that’s progressively increased earnings over time, well into the billions of dollars.

REGN Net Income (Annual) data by YCharts

Regeneron may be best known for Dupixent, a product it commercializes with partner Sanofi, and one that’s delivered blockbuster revenue. Dupixent is sold for eight inflammation-linked conditions, including common ones such as asthma and atopic dermatitis (also known as eczema). More than one million patients worldwide take this drug.

The company also has relied on Eylea for growth. This is a treatment for wet age-related macular degeneration as well as other diseases of the retina. The lower dose form of Eylea has seen growth slow due to competition — and some of the competition has come from Regeneron’s higher dose version of the treatment, Eylea HD. In the recent quarter, for example, Eylea HD saw U.S. revenue soar 66% to more than $500 million. So this product remains a solid growth driver for Regeneron.

Regeneron Pharmaceuticals

Today’s Change

(-0.23%) $-1.77

Current Price

$779.67

Key Data Points

Market Cap

$82B

Day’s Range

$770.00 – $781.46

52wk Range

$476.49 – $821.11

Volume

615K

Avg Vol

888K

Gross Margin

81.56%

Dividend Yield

0.46%

A massive pipeline

What’s particularly important is that Regeneron has an enormous pipeline with many late-stage programs across therapeutic areas. For example, it currently has more than a dozen candidates involved in phase 3 trials, from immunology and inflammation to cardiovascular, oncology, and rare diseases. And this is just to mention candidates that may be approaching the finish line; Regeneron also has a significant number of candidates in earlier-stage trials.

All of this is positive because, even if only a portion of these candidates reaches commercialization, Regeneron may see growth take off in the coming years. And its deep pipeline ensures that growth will continue over time, with new launches to compensate for declines in older drugs.

Right now, Regeneron is trading for 17x forward earnings estimates, down from more than 25x in the second half of 2024. Considering this biotech’s track record of growth and its solid pipeline, it’s a no-brainer buy at these levels — and a stock you won’t want to let go.