Key Points

- Starting January 1, 2026, forgiven federal or private student-loan balances may once again be considered taxable income.

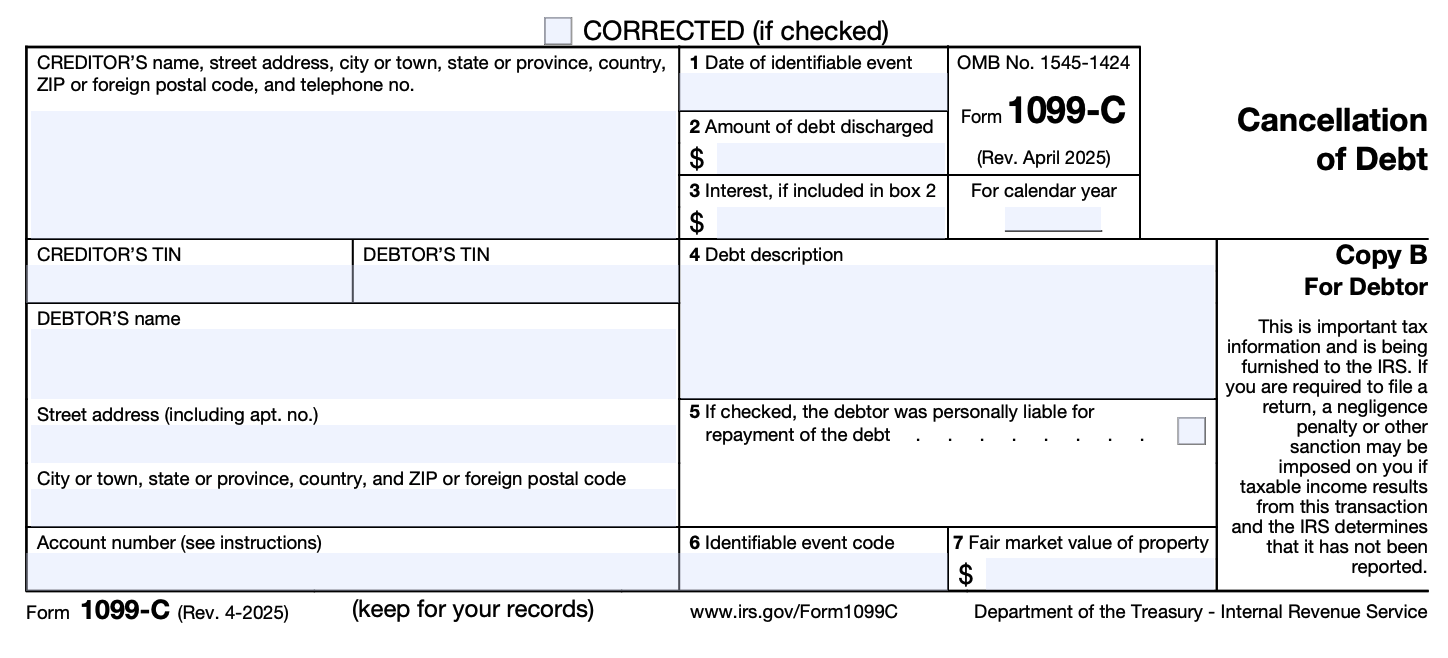

- If forgiveness occurs in 2026 or later, you’ll likely receive Form 1099-C (Cancellation of Debt) from your loan holder and may need to report the amount on your tax return.

- The temporary tax exclusion under the American Rescue Plan Act of 2021 expires December 31, 2025.

When any debt is cancelled or forgiven, the IRS generally treats that amount as taxable income – because you received the money, used it, and no longer have to repay it.

That’s why the IRS requires lenders to issue a Form 1099-C showing how much debt was forgiven. You then report it on your tax return, unless you qualify for an exclusion.

Congress temporarily shielded student-loan borrowers from the “student loan tax bomb” under Section 9675 of the American Rescue Plan Act of 2021 (adding IRC § 108(f)(5)), making most student-loan forgiveness tax-free from 2021 through 2025.

However, starting on January 1, 2026, the only student loan forgiveness that remains tax-free is Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Death and Disability Discharge.

Would you like to save this?

What’s New For 2026 And Beyond

- End of the Tax-Free Window: The temporary exemption for forgiven student loans under federal law expires December 31, 2025.

- Department of Education Guidance: Borrowers whose forgiveness is completed in 2025 under IBR or ICR plans will not receive a 1099-C. Those whose forgiveness occurs in 2026 or later will.

- Forgiveness is Based On Date You Reach Milestone: The date that counts for forgiveness and taxes is when you reach the forgiveness milestone (240 or 300 payments), not necessarily when the Department of Education processes it.

- Private Loan Settlements Included: Private student-loan discharges also become taxable again.

- State Differences: Some states may continue to exclude student-loan forgiveness from taxable income, but others could follow federal law. Check your state department of revenue guidance each filing season.

Understanding Form 1099-C

A Form 1099-C is the IRS document used to report canceled or discharged debt of $600 or more. For student loans, it’s issued by your loan holder or servicer when your balance is forgiven outside the 2021-25 tax-free window.

What Each Box Means

- Box 1: Date of identifiable event (the forgiveness date)

- Box 2: Amount of debt discharged (the amount you may need to report as income)

- Box 3: Interest, if included in Box 2

- Box 4: Description of debt (usually blank or the loan identifier)

- Box 6: Reason Code

Each code in Box 6 corresponds to a specific cancellation event. Most borrowers with federal student loans will get Code F.

- Code A – Bankruptcy: Debt canceled as part of a bankruptcy proceeding.

- Code B – Identifiable Event: Debt canceled due to an identifiable event such as a foreclosure.

- Code C – Expedited Charge-Off: Debt written off earlier than usual by the creditor.

- Code D – Debt Discharge in a Settlement Agreement: Debt canceled as part of a settlement between debtor and creditor.

- Code E – Debt Forgiveness: Debt reduced or forgiven through negotiation or agreement.

- Code F – Government or IRS Discharge: Debt canceled by the IRS or another government agency.

If you receive this form, keep it with your records and compare the amount to your loan servicer’s statement. You’ll report it on your tax return using IRS Form 982 if you qualify for an exception like insolvency.

How Does A 1099-C Affect My Taxes?

The 1099-C will report how much student debt was forgiven. First, check this amount against your records. If it’s wrong, contact the creditor, whose contact info will be provided in the form.

On the form, box 2 shows you the amount of debt discharged — you’ll need to put that in the “Other income” line on your 1040 tax form. That amount will essentially be added to your adjusted gross income on your taxes and will be taxed as income. The federal government counts any cancelled debt as a lump sum of money handed to you to pay off the rest of the debt.

What does that mean? In short, you will be expected to pay taxes on more income than you earned in wages.

Depending on the amount discharged, that additional “income” may push you into the next tax bracket, increasing the percentage you pay in taxes not only on the discharged debt but on your normal income also. Furthermore, that additional income may disqualify you from claiming some deductions and credits that usually lower your tax burden.

Example: The Return of the Tax Bomb

Jamie has $25,000 remaining after making 300 qualifying payments on the IBR plan.

- If payment 300 happens in October 2025, Jamie receives no 1099-C and pays no tax.

- If payment 300 happens in January 2026, Jamie receives a 1099-C for $25,000 and may owe income tax on that amount when filing her 2026 return in 2027.

That additional $25,000 is treated like ordinary income, and based on the federal tax bracket she is in, she may pay up to $9,250. However, that’s an unlikely amount because it would mean that she also earned over $626,000 – meaning she likely won’t have a $25,000 loan remaining.

Most borrowers won’t face a tax bomb due to insolvency. And even if they do, it’s a very low amount.

The College Investor Tax Bomb Estimator can help you understand the scenarios and the amount you could pay.

What You Can Do Now

If you’re approaching student loan forgiveness under IDR plan forgiveness or borrower defense to repayment (the most common taxable scenarios), here’s some steps you can take:

1. Confirm Your Timeline

Log into your loan servicer account to check your qualifying payment count. If you’re on track to reach forgiveness by late 2025 you’ll avoid the tax bomb. But after January 1, 2026, you’ll face additional tax liability.

2. Estimate Potential Tax Impact

If your forgiveness date falls in 2026 or later, use your marginal tax rate to estimate the bill. Example: a $25,000 discharge at a 22% rate creates a $5,500 federal liability. Use The College Investor’s Tax Bomb Calculator to run the numbers.

3. Explore Exceptions

Insolvency or bankruptcy may exempt you from tax on forgiven debt. Use Form 982 to claim exclusion if eligible.

4. Consult a Tax Professional

A CPA or EA can calculate taxable income from a 1099-C and help you plan for payment or withholding adjustments.

The 1099-C is about to return for student-loan borrowers. If your forgiveness occurs before the end of 2025, you’re in the clear. After that, the tax-free era ends. Plan ahead now to avoid surprises when filing your 2026 return.

Don’t Miss These Other Stories:

Student Loan Tax Bomb Calculator And Estimator

Student Loan Tax Bomb Returning In 2026

Which States Tax Student Loan Forgiveness?

Editor: Clint Proctor

Reviewed by: Chris Muller

The post 1099-C And Student Loan Forgiveness: 2026 And Beyond appeared first on The College Investor.