Key Points

- The Department of Education confirmed that existing borrowers will keep access to current standard, extended, and graduated repayment plans after July 1, 2026, if they do not take out new loans.

- The “One Big, Beautiful Bill Act,” signed by President Donald Trump, overhauls federal repayment structures and introduces a new “tiered standard” plan for future borrowers.

- More than 40 million Americans could be affected by these changes, marking the largest shift in repayment rules in decades.

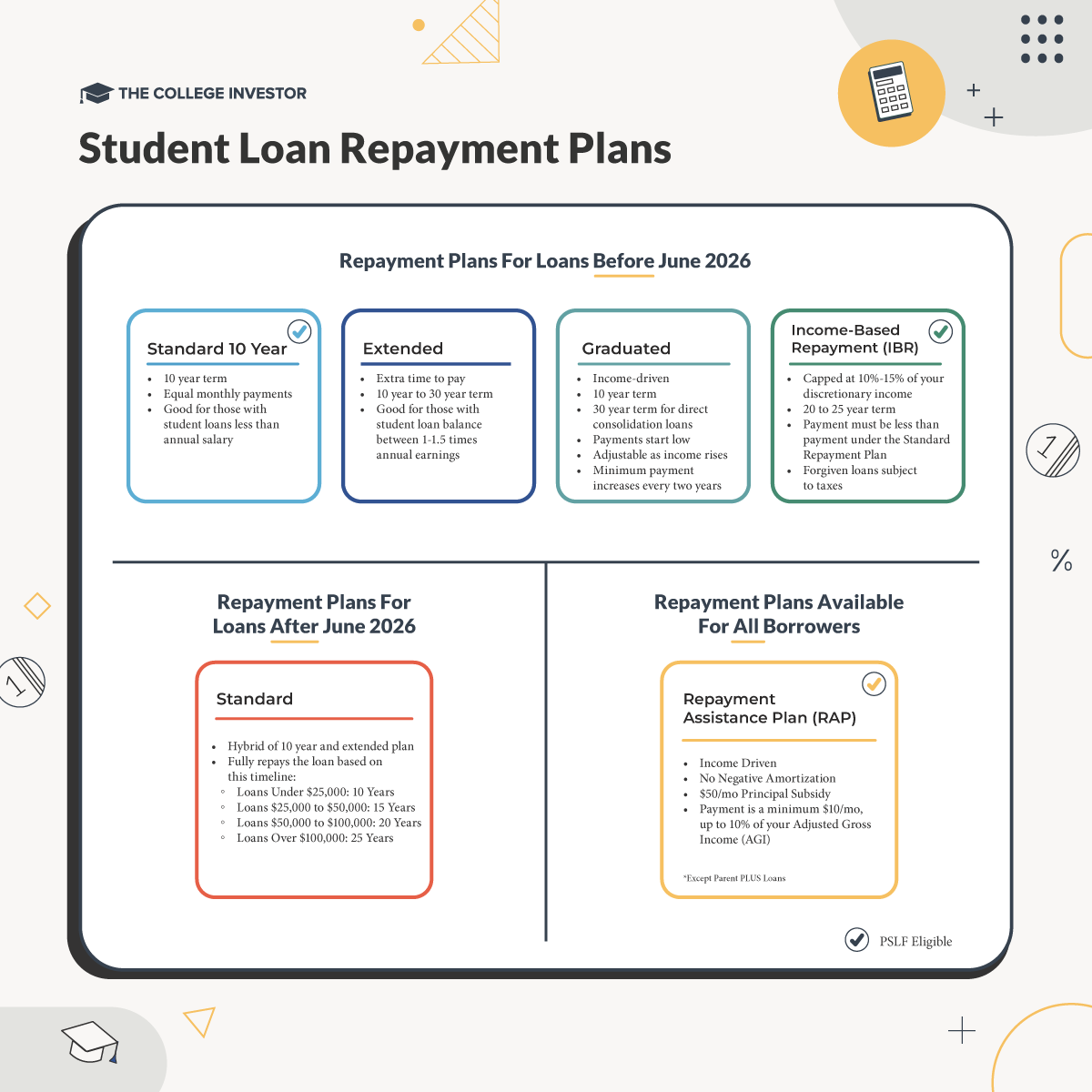

The Department of Education has confirmed that borrowers with existing federal student loans will be able to continue using current fixed repayment plans (including the 10-year Standard, 25-year Extended, and Graduated options) after new rules take effect in mid-2026.

The assurance came during an October meeting of the Reimagining and Improving Student Education (RISE) committee (PDF File), a rulemaking group established to implement the “One Big, Beautiful Bill Act.” The legislation directs the Department of Education to overhaul several aspects of federal student loan repayment.

Under the law, all current fixed repayment plans will be eliminated for borrowers who take out new federal loans or consolidate existing loans on or after July 1, 2026. Those future borrowers will instead be placed on a new “tiered standard” repayment plan that adjusts the repayment term based on the size of their debt.

But for millions of existing borrowers, the Department of Education has clarified that they can remain in their current repayment plans indefinitely, as long as they do not take out new loans or consolidate after that date.

Would you like to save this?

What Changes For New Borrowers

The “One Big, Beautiful Bill Act” effectively collapses the current three fully amortized student loan repayment options into a single plan. Under the proposed “tiered standard” plan, repayment terms will be determined by loan balance:

- Loans Under $25,000: 10 Years

- Loans $25,000 to $50,000: 15 Years

- Loans $50,000 to $100,000: 20 Years

- Loans Over $100,000: 25 Years

This approach aims to simplify repayment while aligning payment schedules more closely with the amount borrowed. Monthly payments would remain fixed, but the repayment term would vary depending on amount borrowed — providing longer terms for larger debts.

All negotiators participating in the RISE committee gave the draft language on fixed repayment plans a “thumbs up” during a preliminary consensus check, suggesting the department is likely to finalize this portion of the rule with broad agreement.

If the committee continues to reach full consensus in the next meeting, the Department of Education is generally required to adopt the agreed-upon language in its final rule. Without consensus, the department would have greater flexibility to interpret and implement the statute independently.

What Borrowers Need To Know

The confirmation means that current borrowers (including those still in school or in grace periods) will retain access to their existing repayment options, even if they enter repayment after 2026 because the rule is based on loan origination date. The key condition is that they must not take out any new federal student loans after the July 1, 2026, cutoff.

Borrowers who later return to school and take on new loans could lose access to the legacy plans entirely, since the new disbursement would fall under the updated system. Similarly, consolidating loans after that date could move a borrower’s entire balance into the new “tiered standard” structure. This would be the case, for example, with future Parent PLUS borrowers.

The change also means that loan servicers will be managing two sets of repayment systems simultaneously — one for borrowers with pre-2026 loans under the old plans, and another for new borrowers under the new tiered structure.

Servicers have indicated support for this clarity, which will help prevent confusion during the transition period.

Key Takeaways

The new framework represents one of the most sweeping restructurings of federal student loan repayment in decades. While income-driven repayment plans have received the most attention in recent years, fixed repayment options remain the default for millions of borrowers.

According to our student loan statistics, over half of borrowers are in a standard plan (though some are in deferment) and roughly one-third of borrowers are currently repaying their loans on standard, extended, or graduated fixed plans. For these borrowers, the ability to retain their current repayment structure could provide stability and predictability, especially amid ongoing policy changes to income-based programs.

Action Plan:

- Keep your current loans: Borrowers who have existing loans before July 1, 2026, can stay in their current repayment plans as long as they do not take out new loans or consolidate.

- Future loans = new rules: Any new borrowing after July 1, 2026 will fall under the new “tiered standard” plan or have access to the RAP Plan.

- Watch your consolidation date: Consolidating after July 1, 2026, could move all loans into the new repayment system.

Don’t Miss These Other Stories:

Best Student Loan Repayment Plans (Updated For OBBBA)

Can President Trump Reverse Student Loan Forgiveness?

PSLF Checklist: What Student Loan Borrowers Must Do

Editor: Colin Graves

The post Standard Plans Stay For Current Student Loan Borrowers appeared first on The College Investor.