Shares of Nvidia, Broadcom, and Taiwan Semiconductor are set to soar further.

Spending on artificial intelligence (AI) is projected to reach new heights in 2026. It’s clear that hyperscalers see huge potential in this technology, and none of them wants to risk being left behind by their peers.

As a result, they’re spending record amounts on data centers and the computing equipment that goes into them. While there are several ways to invest in the AI building boom — among them, energy companies, construction businesses, or other equipment providers — I view Nvidia (NVDA 2.21%), Broadcom (AVGO 1.87%), and Taiwan Semiconductor Manufacturing (TSM 0.47%) as no-brainer buys to capitalize on the trend.

All three are making plenty of money from it right now, and odds are, they will make even more over the next few years as the huge spending continues.

Image source: Getty Images.

The AI building boom is just beginning

Over the past few weeks, we’ve heard from Amazon, Alphabet, and Meta Platforms about what they plan to lay out this year on capital expenditures. Amazon told investors to expect $200 billion, while Alphabet gave a range of $175 billion to $185 billion. Meta’s guidance was the lowest of the group — it expects to spend in the range of $115 billion to $135 billion. Together, that’s over $500 billion if each lands at the midpoint of its forecast range, and it doesn’t even include what Microsoft will spend.

Where is all of that money going? To build data centers and buy the equipment that goes inside them. The two companies standing to benefit the most from this spending are Nvidia and Broadcom, as chips can account for nearly half of the cost of constructing a data center. Taiwan Semiconductor also will continue to be a huge beneficiary since it manufactures most of the chips that Nvidia and Broadcom design.

Today’s Change

(-2.21%) $-4.13

Current Price

$182.81

Key Data Points

Market Cap

$4.4T

Day’s Range

$181.59 – $187.55

52wk Range

$86.62 – $212.19

Volume

5.4M

Avg Vol

180M

Gross Margin

70.05%

Dividend Yield

0.02%

All three of these stocks are set to boom thanks to this unprecedented spending by AI hyperscalers, but 2026 is really just the beginning. The reality is, we won’t know the true benefits of generative AI for years to come.

And the hyperscalers aren’t going to wait around for more evidence. The preliminary uses appear to warrant spending huge amounts of money on infrastructure to support the technology, and nobody wants to be left behind. That’s why companies like Nvidia have offered impressive five-year projections: It forecasts that global data center capex will reach $3 trillion to $4 trillion annually by 2030.

That’s a huge step up from where it’s at now, and funding these infrastructure projects at that level would require generative AI technology to start being monetized at a greater rate. But if that prediction proves accurate, shares of Broadcom, Nvidia, and Taiwan Semiconductor could skyrocket.

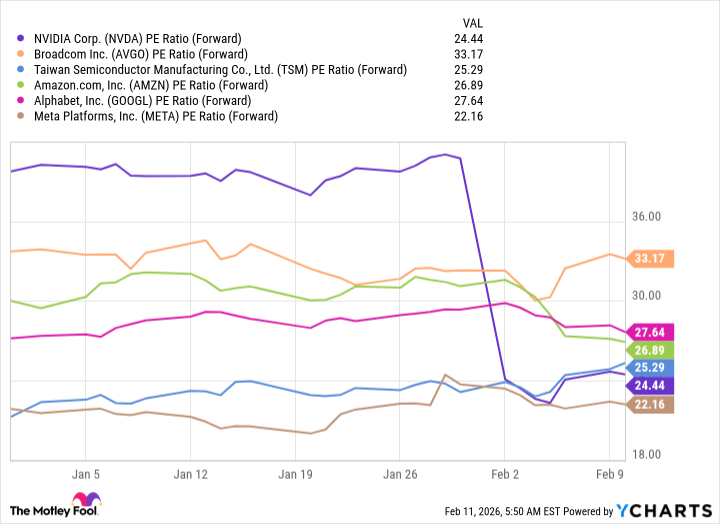

This trio doesn’t trade at huge premiums

Despite all of the growth that they are set to experience from huge AI spending, the market hasn’t assigned these companies significant premiums compared to their peers.

NVDA PE Ratio (Forward) data by YCharts; PE = price to earnings.

However, Nvidia, Broadcom, and Taiwan Semiconductor are all expected to deliver impressive revenue growth. Wall Street analysts project 64% growth for Nvidia’s fiscal 2027 (which ends January 2027), and forecast that in 2026, Broadcom’s top line will rise by 51%, and Taiwan Semiconductor’s will increase by 34%. Those are all impressive rates and are far faster than their peers, so a premium valuation should be warranted.

Because these stocks are not trading at a premium, I think they’re excellent buys at today’s prices. The AI buildout is only going to intensify over the next few years, and this trio will be there to power all of the new workloads coming online.

Keithen Drury has positions in Alphabet, Amazon, Broadcom, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.