Investors seeking market-beating returns should take a closer look at these stocks before they soar higher.

One of the best ways to see your investments in the stock market grow is to buy and hold solid stocks for the long run. After all, this buy-and-hold strategy enables investors to capitalize on disruptive and secular growth trends while also benefiting from the power of compounding.

Let’s say if you have $1,000 in investible cash right now after paying your bills, clearing your high-interest loans, and saving for difficult times, you can consider putting that money (either individually or combined) into top growth stocks such as Palantir Technologies (PLTR +1.77%) and Vertiv Holdings (VRT 0.19%).

Let’s look at the reasons why these stocks could be winners in the long run.

Image source: Getty Images.

Palantir is showing investors that AI is indeed driving solid profitability

Palantir Technologies’ artificial intelligence (AI) software platform has gained tremendous traction among customers, driven by its ability to boost productivity, increase automation, and reduce redundancy.

Today’s Change

(1.77%) $2.36

Current Price

$135.38

Key Data Points

Market Cap

$323B

Day’s Range

$134.87 – $140.96

52wk Range

$66.12 – $207.52

Volume

60M

Avg Vol

45M

Gross Margin

82.37%

The company finished 2025 with a 56% jump in revenue to $4.48 billion. The company’s adjusted earnings increased at a faster pace of 83% to $0.75 per share. The faster growth in Palantir’s earnings is due to higher spending by existing customers plus the larger deals it is signing.

For instance, Palantir signed 180 deals worth $1 million or more in the fourth quarter of 2025, up from 129 in the year-ago period. The number of deals valued at $10 million or more nearly doubled. This explains why Palantir expects its revenue growth rate to accelerate to almost 61% in 2026. Analysts are predicting a 76% increase in earnings this year, well above the 16% average earnings growth of companies in the S&P 500 index.

However, Palantir could do better than that, as its customer count increased by 34% in 2025, and the new customers that come into its fold tend to enhance their deployment of its AI software solutions across their operations. Also, the long-term opportunity in AI software could send Palantir stock soaring over the next five years, which is why it would be a good idea for investors seeking market-beating returns to buy this AI stock.

Vertiv’s huge order book points toward better times

The global AI infrastructure boom has been a boon for Vertiv. After all, the company is in the business of designing, manufacturing, and servicing critical data center components related to power management, cooling, and server racks.

Today’s Change

(-0.19%) $-0.46

Current Price

$243.07

Key Data Points

Market Cap

$93B

Day’s Range

$240.41 – $253.87

52wk Range

$53.60 – $255.54

Volume

206K

Avg Vol

6.4M

Gross Margin

34.26%

Dividend Yield

0.07%

With the investment in data center systems expected to clock 32% growth in 2026 to more than $650 billion, according to Gartner, Vertiv is in a nice position to accelerate its growth. The company posted a 28% jump in overall revenue in 2025 to $10.2 billion. It is expecting a faster increase of 32% in 2026 to $13.5 billion, along with a 43% spike in adjusted earnings to $6.02 per share.

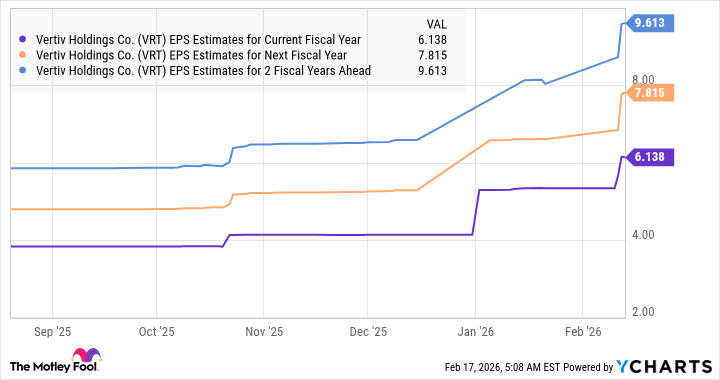

Analysts, however, are more bullish about Vertiv’s growth.

VRT EPS Estimates for Current Fiscal Year data by YCharts

That’s not surprising as AI infrastructure spending is anticipated to hit $1.4 trillion by 2030. This lucrative opportunity is helping Vertiv build a solid order book. It witnessed an 81% increase in orders in 2025, exiting the year with a backlog of $15 billion. The revenue backlog jumped by 109% last year, exceeding the growth in its revenue.

This backlog, along with the bump in AI infrastructure spending, positions Vertiv nicely for robust long-term gains. All this makes Vertiv an ideal growth stock to buy right now before it soars higher.