Both stocks have delivered stunning gains this year, and one of them is still a no-brainer buy.

Nebius Group (NBIS 5.17%) and CoreWeave (CRWV 1.92%) set the stock market on fire this year, clocking stunning gains of more than 200% as of this writing, thanks to their phenomenal growth.

While Nebius’ stock is up 309% so far in 2025, shares of CoreWeave have shot up 233% in a span of just six months since its initial public offering. Importantly, both companies look capable of sustaining their outstanding growth long-term thanks to the booming demand for their dedicated artificial intelligence (AI) cloud infrastructure.

But if you had to choose from one of these two high-flying growth stocks for your portfolio, which one should it be? Let’s find out.

Image source: Getty Images.

The case for Nebius

Nebius got a massive shot in the arm recently after announcing a five-year contract with Microsoft worth $17.4 billion. The deal, which could go up to $19.4 billion if Microsoft opts to use additional Nebius services, is going to be a game-changer for the company.

That’s because Nebius is currently a small company with $156 million in revenue in the first half of 2025. However, that number is growing at an incredible pace, with the top line jumping 545% year over year in the first six months of the year. Analysts project Nebius will end the year with a 390% increase in revenue to $576 million. The Microsoft contract, therefore, is a big deal for Nebius as it has the potential to make Nebius a significantly bigger company in the long run.

What’s more, investors can expect Nebius to land more such contracts. Due to a shortage of cloud computing capacity to run AI workloads, companies like Microsoft are sitting on huge backlogs. Even other cloud computing giants such as Alphabet‘s Google and Amazon saw significant increases in their backlogs thanks to the rapidly growing demand for training and running of AI applications in the cloud.

Nebius is working to bring more data center capacity online, which should eventually allow it to win more business and sustain strong revenue growth levels. Even before Nebius announced the Microsoft contract, it was on track to secure more than 1 gigawatt (GW) of contracted data center capacity by the end of 2026.

This would enable Nebius to bring online more data centers in the coming year, significantly expanding its capacity from 220 megawatts (MW) at the end of the previous quarter. And now, there is a solid chance that Nebius’ capacity growth could be higher than expected since it is going to use the funds from the Microsoft contract to finance new data center construction so that it can satisfy the AI computing needs of the tech giant.

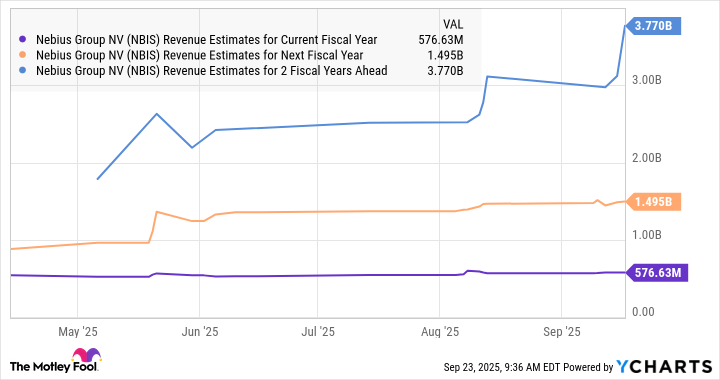

As a result, Nebius’ revenue growth estimates for 2027 have taken off.

Data by YCharts.

The chart above suggests that Nebius’ top line could jump by more than 6.5x in the space of just two years, which means that it is likely to remain a top AI stock in the future.

The case for CoreWeave

Nebius and CoreWeave have a similar business model of renting out their graphics processing unit (GPU)-powered data centers to customers looking to run AI workloads in the cloud. Not surprisingly, CoreWeave is also growing at an incredible pace. Its revenue in the first six months of 2025 shot up an impressive 275% year over year to $2.2 billion.

What’s more, CoreWeave’s 2025 revenue outlook of $5.25 billion suggests that its business is on track to accelerate in the second half of the year. That won’t be surprising for two reasons.

First, CoreWeave is expanding its data center capacity at a robust pace. It had 470 MW of data center capacity at the end of Q2, and plans to end the year with 900 MW of connected capacity at its disposal. CoreWeave, therefore, has more capacity on hand than CoreWeave. Even better, it has increased its total contracted data center capacity to 2.2 GW. So, CoreWeave has more capacity than Nebius, which explains why CoreWeave’s revenue is much higher. Also, CoreWeave’s planned acquisition of Core Scientific is going to further boost its capacity expansion efforts.

Second, CoreWeave was sitting on a massive revenue backlog of $30.1 billion at the end of Q2. This metric jumped 86% year over year on the back of new contracts from OpenAI, as well as from its existing customers. As CoreWeave brings online more data center capacity, it should be able to convert more of this backlog into actual revenue.

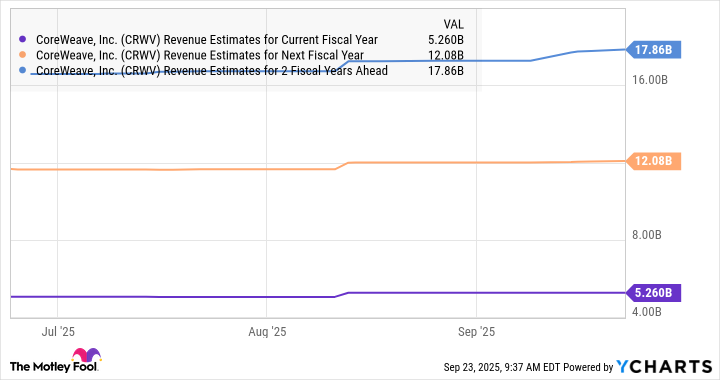

So, it is easy to see why analysts expect CoreWeave to sustain impressive revenue growth levels going forward.

Data by YCharts.

The verdict

Both Nebius and CoreWeave are growing at an incredible pace, and their momentum is likely to continue since the cloud infrastructure market, including both infrastructure-as-a-service and platform-as-a-service, is expected to generate close to $1.2 trillion in revenue by the end of the decade.

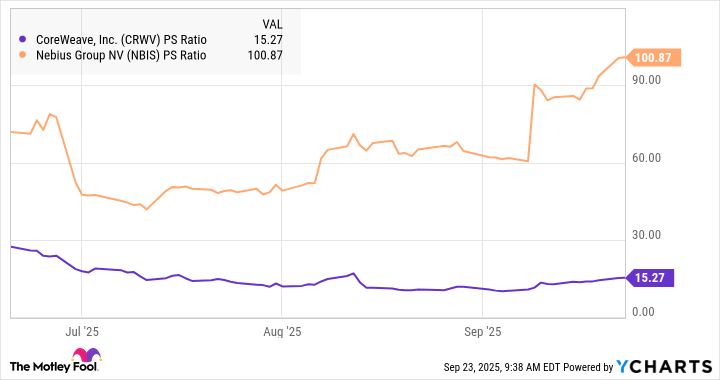

So, choosing one of these two AI stocks for your portfolio depends on the valuation. This is another area where CoreWeave trumps Nebius by a wide margin (in addition to CoreWeave’s larger data center capacity).

Data by YCharts.

CoreWeave, therefore, allows investors to capitalize on the booming cloud AI infrastructure market at a much lower valuation, owing to its significantly cheaper price-to-sales ratio, making it easy for investors to choose it over Nebius. But at the same time, the potential acceleration in Nebius’ growth owing to the Microsoft contract could allow it to justify its valuation, which is why more adventurous investors can consider this cloud stock even though it is very expensive right now.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends Nebius Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.