2026 is shaping up to be another excellent year for the stock market.

With 2025 nearly over, it’s a good time for investors to think about which companies they might want to add to their portfolios in 2026. A market pullback can happen at any time, so having a shopping list ready to go is a smart idea.

Here are my top 10 stock picks for 2026. I’m fairly confident that each of them will outperform the market next year.

Image source: Getty Images.

1. Nvidia

This is just a list of stocks — it’s not in ranked order. However, if it were in ranked order, there’s a good chance that Nvidia (NVDA +3.80%) would still be No. 1. The chipmaker has been the face of the artificial intelligence (AI) buildout since it began in 2023, and that trend shows no signs of stopping in 2026.

Today’s Change

(3.80%) $6.62

Current Price

$180.76

Key Data Points

Market Cap

$4.4T

Day’s Range

$176.44 – $181.06

52wk Range

$86.62 – $212.19

Volume

7.4M

Avg Vol

193M

Gross Margin

70.05%

Dividend Yield

0.02%

Hyperscalers are slated to spend record amounts on capital expenditures in 2026. Most of that money is going toward constructing data centers and filling them with computing equipment, such as Nvidia’s graphics processing units (GPUs). Nvidia projects that by 2030, global data center capital expenditures will total $3 trillion to $4 trillion. If that forecast proves accurate, Nvidia will be a top stock to own in 2026 and several years beyond.

2. AMD

AMD (AMD +6.17%) has played second fiddle to Nvidia in the GPU market for many years, but it could start closing the gap. AMD’s offerings are far more competitive than they were just a few years ago, and management believes it can capture more of the market for the new AI workloads coming online.

The company projects that its data center revenue growth rate will rise to a 60% compound annual growth rate over the next five years. In Q3, its data center growth rate was 22%. If it can accelerate its growth to that 60% level, AMD will be a winning stock pick in 2026.

3. Broadcom

Chipmaker Broadcom (AVGO +3.18%) is taking a different approach to AI computing. Instead of offering general-purpose GPUs like AMD and Nvidia, it’s partnering with hyperscalers to design custom AI accelerators that are optimized to handle the needs of their workloads. These application-specific integrated circuits can provide better performance at lower costs, but at the cost of reduced flexibility. Many cloud giants are willing to make that trade, and Broadcom’s growth is accelerating as a result.

Today’s Change

(3.18%) $10.48

Current Price

$340.36

Key Data Points

Market Cap

$1.6T

Day’s Range

$332.58 – $343.45

52wk Range

$138.10 – $414.61

Volume

159M

Avg Vol

28M

Gross Margin

64.71%

Dividend Yield

0.69%

In the fourth quarter of its fiscal 2025 (which ended Nov. 2), Broadcom’s AI semiconductor revenue rose 74% year over year, and management expects that growth rate to accelerate to above 100% in its Q1 fiscal 2026.

4. Taiwan Semiconductor Manufacturing

Nvidia, AMD, and Broadcom are all fabless chip companies: They design chips, but outsource the manufacturing of them to specialists like Taiwan Semiconductor (TSM +1.50%). It is by far the world’s largest chip foundry by revenue, and with its industry dominance, that likely won’t change anytime soon.

As long as high AI infrastructure spending continues, Taiwan Semiconductor will be a great investment, as it’s a neutral player in the AI realm. That spending is expected to rise again in 2026, boding well for Taiwan Semi.

5. Alphabet

Alphabet (GOOG +1.60%)(GOOGL +1.47%) is becoming a force to be reckoned with in the AI realm. Originally, its generative AI model, Gemini, was viewed as inferior to its rivals. But now, it’s seen as one of the leaders in the space.

Today’s Change

(1.47%) $4.45

Current Price

$306.91

Key Data Points

Market Cap

$3.7T

Day’s Range

$300.97 – $307.20

52wk Range

$140.53 – $328.83

Volume

1.1M

Avg Vol

37M

Gross Margin

59.18%

Dividend Yield

0.27%

Furthermore, Alphabet has a thriving base business (Google Search), as well as a strong cloud computing offering in Google Cloud. It’s hard to find a weak spot in Alphabet’s business right now.

6. Meta Platforms

Shares of Meta Platforms (META 0.85%) tumbled after it reported its Q3 results, with the market apparently reacting unfavorably to its high capital expenditure plans. However, that response ignores how strong the base business was in the quarter. Meta’s revenue rose by 26% year over year, thanks to the effects of AI on its platforms.

This growth will likely persist throughout 2026, and investors will come back around to Meta stock once they realize that all the other tech giants in its megacap cohort are spending just as heavily on AI as Meta is. The stock’s current discount is a great buying opportunity, and investors should take advantage.

7. Amazon

Amazon (AMZN +0.21%) stock has performed poorly in 2025: It’s only up about 3% so far this year. However, that wasn’t because Amazon’s business struggled. Its revenue rose at a 13% pace in Q3, led by its strong advertising division and cloud computing segment, Amazon Web Services.

Both of these businesses are expected to thrive in 2026. With each accounting for a significant chunk of Amazon’s profits, that bodes well for the stock’s chances of regaining its momentum.

8. PayPal

PayPal (PYPL +0.62%) stock has fallen by around 30% in 2025. However, it hasn’t been as bad a year for the payment processing giant’s business as that result would suggest.

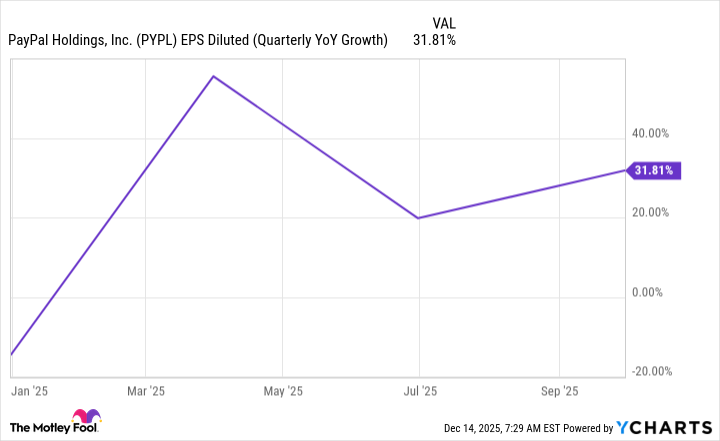

PYPL EPS Diluted (Quarterly YoY Growth) data by YCharts. EPS = earnings per share. YoY = year over year.

PayPal delivered strong diluted earnings per share (EPS) growth in 2025, and that trend could continue in 2026, particularly if it continues its share buybacks. PayPal’s stock is dirt cheap at 11.5 times forward earnings, making it an attractive stock to buy.

9. The Trade Desk

The Trade Desk (TTD 0.17%) has had a disappointing year as well, with its stock falling by around 70% so far. When it switched to its AI-powered ad-buying platform, Kokai, its platform migration was poorly executed, leading to problems for its clients. This caused some clients to pull back on their spending with it, and it lost business to Amazon.

However, The Trade Desk is still in a great spot and is expected to grow revenue in 2026 at a 16% pace, according to Wall Street analysts. Combine that with its forward price-to-earnings ratio of 20, and you have a recipe for a stock that could outperform in 2026.

10. MercadoLibre

Last but not least is MercadoLibre (MELI +1.63%), a Latin American e-commerce and fintech giant that has posted year after year of successful quarters. The stock is up by around 20% for the year, but down by more than 20% from the high it hit in July.

MercadoLibre is the dominant e-commerce company in Latin America, and its growth is far from over. Previous pullbacks in MercadoLibre’s stock over the past few years have proven to be excellent buying opportunities, and the current one looks no different.