It’s almost tax season! And the number one question we see every year is: when can I expect my tax refund? Most taxpayers receive their IRS tax refund within 21 days of filing, but actual dates vary depending on when your return is accepted, how you file, and whether you claim certain tax credits.

For the 2026 filing season, we expect the IRS to open e-file submissions in February and issue the first direct deposits by late February. Returns that include the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) will continue to be held until after February 15, as required by law.

The College Investor’s annual IRS Tax Refund Calendar below shows the estimated deposit and check mailing dates based on IRS acceptance timing and direct deposit preferences. These are projections, not guarantees — but year after year, they closely match real refund data reported by our readers.

⚠︎ Key Tax Dates This Year ⚠︎

|

Event |

Timing |

|---|---|

|

IRS e-File Opens |

February 17, 2026 |

|

First Direct Deposits |

February 27, 2026 |

|

PATH Act Refunds Released |

March 6, 2026 |

|

First Paper Check Refunds |

March 6, 2026 |

|

Personal Tax Filing Deadline |

April 15, 2026 |

We believe the IRS will be opening tax season exceptionally late this year based on comments by the IRS commissioner, along with the workload impacts of the government shutdown and changes due to the One Big Beautiful Bill Act (OBBBA).

Would you like to save this?

Get Your Tax Refund Faster

If you’re looking to get your tax return faster, check out this list of banks that allow you to get your tax refund a few days early.

While getting your tax return is exciting, consider saving it in one of these top savings accounts.

2026 IRS Tax Refund Schedule Chart

Here is a chart of when you can expect your tax refund for when the return was accepted (based on e-Filing). This is an estimate, but based on past information, does seem accurate for about 90% of taxpayers. Also, as always, you can use the link after the calendar to get your specific refund status.

When can you file your 2025 federal tax return in 2026? Filing season is anytime between February 17 and April 15, 2026.

Now, when to expect my tax refund based on when it’s accepted!

Note: The IRS sends direct deposits to bank accounts every business day during tax season. Our goal is to provide the end of the week in which you should hopefully receive your tax refund.

Looking for a printable version of this tax refund schedule for 2026? Check out this link to DOWNLOAD THE PDF VERSION HERE.

Want an HTML version? See below:

|

2026 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Earliest Direct Deposit |

Paper Check Mailed |

|

Feb 17 – Feb 21, 2026 |

Feb 27, 2026 |

Mar 6, 2026 |

|

Feb 22 – Feb 28, 2026 |

Mar 6, 2026 |

Mar 13, 2026 |

|

Mar 1 – Mar 7, 2026 |

Mar 13, 2026 |

Mar 20, 2026 |

|

Mar 8 – Mar 14, 2026 |

Mar 20, 2026 |

Mar 27, 2026 |

|

Mar 15 – Mar 21, 2026 |

Mar 27, 2026 |

Apr 3, 2026 |

|

Mar 22 – Mar 28, 2026 |

Apr 3, 2026 |

Apr 10, 2026 |

|

Mar 29 – Apr 4, 2026 |

Apr 10, 2026 |

Apr 17, 2026 |

|

Apr 5 – Apr 11, 2026 |

Apr 17, 2026 |

Apr 24, 2026 |

|

Apr 12 – Apr 18 2026 |

Apr 24, 2026 |

May 1, 2026 |

|

Apr 19 – Apr 25, 2026 |

May 1, 2026 |

May 8, 2026 |

|

Apr 26 – May 2, 2026 |

May 8, 2026 |

May 15, 2026 |

|

May 3 – May 9, 2026 |

May 15, 2026 |

May 22, 2026 |

|

May 10 – May 16, 2026 |

May 22, 2026 |

May 29, 2026 |

|

May 17 – May 23, 2026 |

May 29, 2026 |

Jun 5, 2026 |

|

May 24 – May 30, 2026 |

Jun 5, 2026 |

Jun 12, 2026 |

|

May 31 – Jun 6, 2026 |

Jun 12, 2026 |

Jun 19, 2026 |

|

Jun 7 – Jun 13, 2026 |

Jun 19, 2026 |

Jun 26, 2026 |

|

Jun 14 – Jun 20, 2026 |

Jun 26, 2026 |

Jul 3, 2026 |

|

Jun 21 – Jun 27, 2026 |

Jul 3, 2026 |

Jul 10, 2026 |

|

Jun 28 – Jul 4, 2026 |

Jul 10, 2026 |

Jul 17, 2026 |

|

Jul 5 – Jul 11, 2026 |

Jul 17, 2026 |

Jul 24, 2026 |

|

Jul 11 – Jul 18, 2026 |

July 24, 2026 |

Jul 31, 2026 |

|

Jul 19 – Jul 25, 2026 |

Jul 31, 2026 |

Aug 7, 2026 |

|

Jul 26 – Aug 1, 2026 |

Aug 7, 2026 |

Aug 14, 2026 |

Important Note for PATH Act Filers: Your tax refund will be delayed until early March. Learn more about the PATH Act delays here.

What If You File A Tax Extension In 2026?

If you file a tax extension in 2026, you can extend your personal tax deadline until October 15, 2026. Remember, if you choose to file a tax extension for your Federal tax return, you are still required to pay any taxes you may owe by the April deadline. If you are expecting a tax refund, that doesn’t really matter – but you still need to file to claim your refund.

Here’s a modified tax refund calendar specifically for those who filed a tax extension. We didn’t want to clutter the above chart given the dates for filing an extension are typically 6 months later. However, the rule of 21 days on average still applies if you file a tax extension and claim your refund later.

|

2026 IRS Tax Extension Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Aug 2 – Aug 8, 2026 |

Aug 14, 2026 |

Aug 21, 2026 |

|

Aug 9 – Aug 15, 2026 |

Aug 21, 2026 |

Aug 28, 2026 |

|

Aug 16 – Aug 22, 2026 |

Aug 28, 2026 |

Sep 4, 2026 |

|

Aug 23 – Aug 29, 2026 |

Sep 4, 2026 |

Sep 11, 2026 |

|

Aug 30 – Sep 5, 2026 |

Sep 11, 2026 |

Sept 18, 2026 |

|

Sep 6 – Sep 12, 2026 |

Sept 18, 2026 |

Sept 25, 2026 |

|

Sep 13 – Sep 19, 2026 |

Sept 25, 2026 |

Oct 2, 2026 |

|

Sep 20 – Sep 26, 2026 |

Oct 2, 2026 |

Oct 9, 2026 |

|

Sept 27 – Oct 3, 2026 |

Oct 9, 2026 |

Oct 16, 2026 |

|

Oct 4 – Oct 10, 2026 |

Oct 16, 2026 |

Oct 23, 2026 |

|

Oct 11 – Oct 17, 2026 |

Oct 23, 2026 |

Oct 30, 2026 |

|

Oct 18 – Oct 24, 2026 |

Oct 30, 2026 |

Nov 6, 2026 |

What’s New For 2026?

The big change for 2026 is the likely delayed start to tax season. At the Tax Summit of the National Association of Enrolled Agents in Salt Lake City, IRS Commissioner Billy Long said the start of the 2026 tax season should be around Presidents Day, which is February 16.

When you combine that with the government shutdown and the massive changes required to implement the OBBBA, we agree that tax season will be delayed this year.

The result is that eFiling will open later, which will delay tax refunds for millions of Americans.

IRS Processing Timeline Explained

The IRS typically issues most refunds within 21 days of accepting your e-filed return. That 21-day clock doesn’t start when you file your taxes – it begins once the IRS officially accepts your return for processing.

Here’s what happens at each stage:

1. Return Accepted → IRS Starts Processing

Once you hit “Submit,” your tax return is time-stamped and transmitted to the IRS. Within 24 to 48 hours, the agency verifies your personal information and either accepts or rejects the return.

An “Accepted” status means your filing passed basic validation checks and entered the IRS processing system.

Notice: If you submit your tax return before eFile opens (which many online tax software services allow), these companies will hold your return and then submit as soon as the IRS begins accepting them. Some lucky filers may get early access in test batches as well.

2. Refund Approved → Deposit Date Set

After your return clears initial verification, the IRS confirms your refund amount and approves payment.

This step triggers a deposit date, which appears in the “Where’s My Refund?” tool or the IRS2Go mobile app.

3. Refund Sent → Money in Your Account or Check Mailed

Once your refund is sent, it typically takes one to five business days to appear in your bank account.

Paper checks can take longer, depending on U.S. Postal Service delivery times and holidays.

How “Where’s My Refund?” Updates

The IRS updates refund statuses once per day—usually overnight.

You won’t see more frequent changes by checking multiple times a day.

Visit the official IRS tool here: Where’s My Refund?

If you’re getting an error message or issues, check out our full IRS Where’s My Refund Guide And Common Questions.

Early Filers: Expect A Delay In Your Refund

We expect the tax season to be extra delayed in 2026 – due to the IRS commissioner’s comments, changes to tax rules, and the government shutdown.

If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), federal law requires the IRS to hold your entire refund until at least mid-February. This is due to the PATH Act.

For 2026, we expect the IRS to release the first wave of EITC/ACTC refunds to be by March 6, provided there are no issues and you used direct deposit.

⚠ Reminder: Claiming the EITC or ACTC means no refunds before February 15, even if your return was accepted early. “Where’s My Refund” should show updates for most early filers by February 22, 2026.

There are other reasons for delays as well.

Paper Returns

Paper-filed returns take the longest to process because IRS staff must manually enter and verify information. Expect six to eight weeks for processing and mailing (at least), compared with 21 days for e-filers.

Errors or Identity Verification

Even small mistakes (like a misspelled name, incorrect Social Security number, or mismatched W-2 income) can cause delays.

The IRS may also flag your return for additional identity verification if it suspects potential fraud.

Bank Account Issues

If the direct-deposit information on your tax return is wrong, or if your bank account is closed, your refund may be delayed or rerouted as a paper check.

Check that your routing and account numbers are correct before submitting your return.

IRS Review Flags or Offsets

Your refund can also be reduced or held for past-due federal or state taxes, child support, or defaulted federal student loans. Yes, collection activity on student loans resumed – so the IRS will take your tax refund this year if you are in default.

Offsets are handled by the Treasury Offset Program (TOP). If this happens, you’ll receive a mailed notice explaining how your refund was applied.

How To Track Your Tax Refund

Once your return is accepted, you can track progress using IRS tools and your bank’s alerts. Here’s how to check safely and effectively:

IRS “Where’s My Refund?” (Web + App)

The fastest way to get accurate information.

Enter your Social Security number, filing status, and exact refund amount to see your personalized status.

Updates post once daily, typically overnight.

👉 Visit Where’s My Refund

IRS2Go Mobile App

This free IRS2GO app mirrors the same data as the website but adds push notifications.

Download it from your device’s app store to get real-time updates without visiting the IRS site directly.

IRS Phone Line

If it’s been more than four weeks past your expected timeline, you can call 1-800-829-1954 to check status.

Expect long hold times during peak tax season; this line won’t show more detail than the online tools.

Here’s a guide to contacting the IRS and getting a real human.

Bank Notifications

Sometimes your financial institution posts deposits before the IRS site updates.

Enable direct-deposit alerts or daily balance notifications so you’ll know as soon as your refund hits.

Find Your State Tax Refund Too!

If you are waiting on your state tax refund, you can also check the status of that. We have our full guide to Tracking And Finding Your State Tax Refund here >>

Prior Years’ Tax Refund Calendars

Looking for an old IRS refund chart? We saved them for you below.

Here is the 2025 tax refund calendar:

Here is the 2025 tax refund extension calendar:

|

2025 IRS Tax Extension Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Aug 3 – Aug 9, 2025 |

Aug 29, 2025 |

Sep 5, 2025 |

|

Aug 10 – Aug 16, 2025 |

Sep 5, 2025 |

Sep 12, 2025 |

|

Aug 17 – Aug 23, 2025 |

Sep 12, 2025 |

Sep 19, 2025 |

|

Aug 24 – Aug 30, 2025 |

Sep 19, 2025 |

Sep 26, 2025 |

|

Aug 31 – Sep 6, 2025 |

Sep 26, 2025 |

Oct 3, 2025 |

|

Sep 7 – Sep 13, 2025 |

Oct 3, 2025 |

Oct 10, 2025 |

|

Sep 14 – Sep 20, 2025 |

Oct 10, 2025 |

Oct 17, 2025 |

|

Sep 21 – Sep 27, 2025 |

Oct 17, 2025 |

Oct 24, 2025 |

|

Sept 28 – Oct 4, 2025 |

Oct 24, 2025 |

Oct 31, 2025 |

|

Oct 5 – Oct 11, 2025 |

Oct 31, 2025 |

Nov 7, 2025 |

|

Oct 12 – Oct 18, 2025 |

Nov 7, 2025 |

Nov 14, 2025 |

|

Oct 19 – Oct 25, 2025 |

Nov 14, 2025 |

Nov 21, 2025 |

Here is the 2024 tax refund calendar:

Here is the 2024 tax extension refund calendar:

|

2024 IRS Tax Extension Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Aug 4 – Aug 10, 2024 |

Aug 30, 2024 |

Sep 6, 2024 |

|

Aug 11 – Aug 17, 2024 |

Sep 6, 2024 |

Sep 13, 2024 |

|

Aug 18 – Aug 24, 2024 |

Sep 13, 2024 |

Sep 20, 2024 |

|

Aug 25 – Aug 31, 2024 |

Sep 20, 2024 |

Sep 27, 2024 |

|

Sep 1 – Sep 7, 2024 |

Sep 27, 2024 |

Oct 4, 2024 |

|

Sep 8 – Sep 14, 2024 |

Oct 4, 2024 |

Oct 11, 2024 |

|

Sep 15 – Sep 21, 2024 |

Oct 11, 2024 |

Oct 18, 2024 |

|

Sep 22 – Sep 28, 2024 |

Oct 18, 2024 |

Oct 25, 2024 |

|

Sept 29 – Oct 5, 2024 |

Oct 25, 2024 |

Nov 1, 2024 |

|

Oct 6 – Oct 12, 2024 |

Nov 1, 2024 |

Nov 8, 2024 |

|

Oct 13 – Oct 19, 2024 |

Nov 8, 2024 |

Nov 15, 2024 |

|

Oct 20 – Oct 25, 2024 |

Nov 15, 2024 |

Nov 22, 2024 |

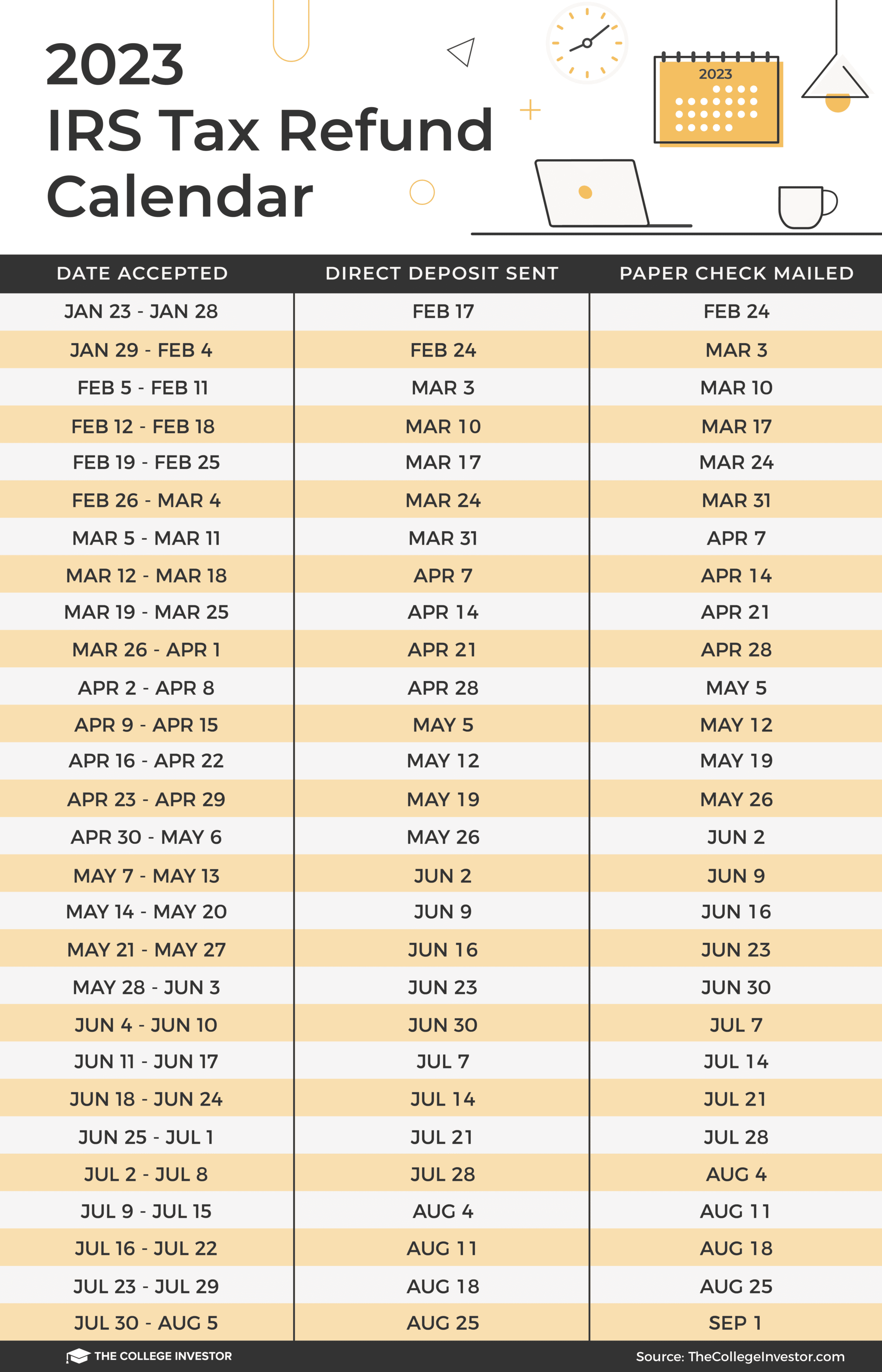

Here is the 2023 IRS refund chart if you’re still wanting to remember what happened last year.

If you are looking for when to expect your tax extension return, see this table:

|

2023 IRS Tax Extension Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Aug 6 – Aug 12, 2023 |

Sep 1, 2023 |

Sep 8, 2023 |

|

Aug 13 – Aug 19, 2023 |

Sep 8, 2023 |

Sep 15, 2023 |

|

Aug 20 – Aug 26, 2023 |

Sep 15, 2023 |

Sep 22, 2023 |

|

Aug 27 – Sep 2, 2023 |

Sep 22, 2023 |

Sep 29, 2023 |

|

Sep 3 – Sep 9, 2023 |

Sep 29, 2023 |

Oct 6, 2023 |

|

Sep 10 – Sep 16, 2023 |

Oct 6, 2023 |

Oct 13, 2023 |

|

Sep 17 – Sep 23, 2023 |

Oct 13, 2023 |

Oct 20, 2023 |

|

Sep 24 – Sep 30, 2023 |

Oct 20, 2023 |

Oct 27, 2023 |

|

Oct 1 – Oct 7, 2023 |

Oct 27, 2023 |

Nov 3, 2023 |

|

Oct 8 – Oct 14, 2023 |

Nov 3, 2023 |

Nov 10, 2023 |

|

Oct 15 – Oct 21, 2023 |

Nov 10, 2023 |

Nov 17, 2023 |

|

Oct 22 – Oct 28, 2023 |

Nov 17, 2023 |

Nov 24, 2023 |

Here is the 2022 IRS refund chart if you’re still wanting to remember what happened last year.

There’s probably not much from 2021 you want to remember, but here’s our tax refund schedule if you are still looking for it.

Coronavirus Pandemic Delays And Date Changes

One of the biggest areas of delays are mail returns. In 2020, we saw mail held up for months, and we expect mail delays to continue. If possible, always eFile. Sending your return via mail will cause significant delays in processing.

If you’ve already filed your return, our assumption is there will be continued delays in processing times. If your return is under review or other information is needed, you may experience significant delays due to staffing.

|

2021 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Feb 12 – Feb 13, 2021 |

Feb 26, 2021 |

Mar 5, 2021 |

|

Feb 14 – Feb 20, 2021 |

Mar 5, 2021 |

Mar 12, 2021 |

|

Feb 21 – Feb 27, 2021 |

Mar 12, 2021 |

Mar 19, 2021 |

|

Feb 28 – Mar 6, 2021 |

Mar 19, 2021 |

Mar 26, 2021 |

|

Mar 7 – Mar 13, 2021 |

Mar 26, 2021 |

Apr 2, 2021 |

|

Mar 14 – Mar 20, 2021 |

Apr 2, 2021 |

Apr 9, 2021 |

|

Mar 21 – Mar 27, 2021 |

Apr 9, 2021 |

Apr 16, 2021 |

|

Mar 28 – Apr 3, 2021 |

Apr 16, 2021 |

April 23, 2021 |

|

Apr 4 – Apr 10, 2021 |

Apr 23, 2021 |

Apr 30, 2021 |

|

Apr 11 – Apr 17, 2021 |

Apr 30, 2021 |

May 7, 2021 |

|

Apr 18 – Apr 24, 2021 |

May 7, 2021 |

May 14, 2021 |

|

Apr 25 – May 1, 2021 |

May 14, 2021 |

May 21, 2021 |

|

May 2 – May 8, 2021 |

May 21, 2021 |

May 28, 2021 |

|

May 9 – May 15, 2021 |

May 28, 2021 |

Jun 4, 2021 |

|

May 16 – May 22, 2021 |

Jun 4, 2021 |

Jun 11, 2021 |

|

May 23 – May 29, 2021 |

Jun 11, 2021 |

Jun 18, 2021 |

|

May 30 – Jun 5, 2021 |

Jun 18, 2021 |

Jun 25, 2021 |

|

Jun 6 – Jun 12, 2021 |

Jun 25, 2021 |

Jul 2, 2021 |

|

Jun 13 – Jun 19, 2021 |

Jul 2, 2021 |

Jul 9, 2021 |

|

Jun 20 – Jun 26, 2021 |

Jul 9, 2021 |

Jul 16, 2021 |

|

Jun 27 – Jul 3, 2021 |

Jul 16, 2021 |

Jul 23, 2021 |

|

Jul 4 – Jul 10, 2021 |

Jul 23, 2021 |

Jul 30, 2021 |

|

Jul 11 – Jul 17, 2021 |

Jul 30, 2021 |

Aug 6, 2021 |

|

Jul 18 – Jul 24, 2021 |

Aug 6, 2021 |

Aug 13, 2021 |

|

Jul 25 – Jul 31, 2021 |

Aug 13, 2021 |

Aug 20, 2021 |

There’s probably not much from 2020 you want to remember, but here’s our tax refund schedule if you are still looking for it:

|

2020 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Jan 27 – Feb 1, 2020 |

Feb 14, 2020 |

Feb 21, 2020 |

|

Feb 2 – Feb 8, 2020 |

Feb 21, 2020 |

Feb 28, 2020 |

|

Feb 9 – Feb 15, 2020 |

Feb 28, 2020 |

Mar 6, 2020 |

|

Feb 16 – Feb 22, 2020 |

Mar 6, 2020 |

Mar 13, 2020 |

|

Feb 23 – Feb 29, 2020 |

Mar 13, 2020 |

Mar 20, 2020 |

|

Mar 1 – Mar 7, 2020 |

Mar 20, 2020 |

Mar 27, 2020 |

|

Mar 8 – Mar 14, 2020 |

Mar 27, 2020 |

Apr 3, 2020 |

|

Mar 15 – Mar 21, 2020 |

Apr 3, 2020 |

Apr 10, 2020 |

|

Mar 22 – Mar 28, 2020 |

Apr 10, 2020 |

Apr 17, 2020 |

|

Mar 29 – Apr 4, 2020 |

Apr 17, 2020 |

April 24, 2020 |

|

Apr 5 – Apr 11, 2020 |

April 24, 2020 |

May 1, 2020 |

|

Apr 12 – Apr 18, 2020 |

May 1, 2020 |

May 8, 2020 |

|

Apr 19 – Apr 25, 2020 |

May 8, 2020 |

May 15, 2020 |

|

Apr 26 – May 2, 2020 |

May 15, 2020 |

May 22, 2020 |

|

May 3 – May 9, 2020 |

May 22, 2020 |

May 29, 2020 |

|

May 10- May 16, 2020 |

May 29, 2020 |

Jun 5, 2020 |

|

May 17 – May 23, 2020 |

Jun 5, 2020 |

Jun 12, 2020 |

|

May 24 – May 30, 2020 |

Jun 12, 2020 |

Jun 19, 2020 |

|

May 31 – Jun 6, 2020 |

Jun 19, 2020 |

Jun 26, 2020 |

|

Jun 7 – Jun 13, 2020 |

Jun 26, 2020 |

Jul 3, 2020 |

|

Jun 14 – Jun 20, 2020 |

Jul 3, 2020 |

Jul 10, 2020 |

|

Jun 21 – Jun 27, 2020 |

Jul 10, 2020 |

Jul 17, 2020 |

|

Jun 28 – Jul 4, 2020 |

Jul 17, 2020 |

Jul 24, 2020 |

|

Jul 5 – Jul 11, 2020 |

Jul 24, 2020 |

Jul 31, 2020 |

|

Jul 12 – Jul 18, 2020 |

Jul 31, 2020 |

Aug 7, 2020 |

|

Jul 19 – Jul 25, 2020 |

Aug 7, 2020 |

Aug 14, 2020 |

|

Jul 26 – Aug 1, 2020 |

Aug 14, 2020 |

Aug 21, 2020 |

Here is the 2019 IRS refund calendar if you’re still looking for it.

|

2019 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Jan 28 – Feb 2, 2019 |

Feb 15, 2019 |

Feb 22, 2019 |

|

Feb 3 – Feb 9, 2019 |

Feb 22, 2019 |

Mar 1, 2019 |

|

Feb 10 – Feb 16, 2019 |

Mar 1, 2019 |

Mar 8, 2019 |

|

Feb 17 – Feb 23, 2019 |

Mar 8, 2019 |

Mar 15, 2019 |

|

Feb 24 – Mar 2, 2019 |

Mar 15, 2019 |

Mar 22, 2019 |

|

Mar 3 – Mar 9, 2019 |

Mar 22, 2019 |

Mar 29, 2019 |

|

Mar 10 – Mar 16, 2019 |

Mar 29, 2019 |

Apr 5, 2019 |

|

Mar 17 – Mar 23, 2019 |

Apr 5, 2019 |

Apr 12, 2019 |

|

Mar 24 – Mar 30, 2019 |

Apr 12, 2019 |

Apr 19, 2019 |

|

Mar 31 – Apr 6, 2019 |

Apr 19, 2019 |

April 26, 2019 |

|

Apr 7 – Apr 13, 2019 |

April 26, 2019 |

May 3, 2019 |

|

Apr 14 – Apr 20, 2019 |

May 3, 2019 |

May 10, 2019 |

|

Apr 21 – Apr 27, 2019 |

May 10, 2019 |

May 17, 2019 |

|

Apr 28 – May 4, 2019 |

May 17, 2019 |

May 24, 2019 |

Here is the 2018 tax refund calendar.

|

2018 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Jan 29 – Feb 4, 2018 |

Feb 17, 2018 |

Feb 24, 2018 |

|

Feb 5 – Feb 11, 2018 |

Feb 24, 2018 |

Mar 3, 2018 |

|

Feb 12 – Feb 18, 2018 |

Mar 3, 2018 |

Mar 10, 2018 |

|

Feb 19 – Feb 25, 2018 |

Mar 10, 2018 |

Mar 17, 2018 |

|

Feb 27 – Mar 4, 2018 |

Mar 17, 2018 |

Mar 24, 2018 |

|

Mar 5 – Mar 11, 2018 |

Mar 24, 2018 |

Mar 31, 2018 |

|

Mar 12 – Mar 18, 2018 |

Mar 31, 2018 |

Apr 7, 2018 |

|

Mar 19 – Mar 25, 2018 |

Apr 7, 2018 |

Apr 14, 2018 |

|

Mar 26 – Apr 1, 2018 |

Apr 14, 2018 |

Apr 21, 2018 |

|

Apr 2 – Apr 8, 2018 |

Apr 21, 2018 |

April 28, 2018 |

|

Apr 9 – Apr 15, 2018 |

April 28, 2018 |

May 5, 2018 |

|

Apr 16 – Apr 22, 2018 |

May 5, 2018 |

May 12, 2018 |

|

Apr 23 – Apr 29, 2018 |

May 12, 2018 |

May 19, 2018 |

Still looking for the 2017 tax refund calendar? We saved it for you here:

|

2017 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Jan 23 – Jan 28, 2017 |

Feb 10, 2017 |

Feb 17, 2017 |

|

Jan 29 – Feb 4, 2017 |

Feb 17, 2017 |

Feb 24, 2017 |

|

Feb 5 – Feb 11, 2017 |

Feb 24, 2017 |

Mar 3, 2017 |

|

Feb 12 – Feb 18, 2017 |

Mar 3, 2017 |

Mar 10, 2017 |

|

Feb 19 – Feb 25, 2017 |

Mar 10, 2017 |

Mar 17, 2017 |

|

Feb 27 – Mar 4, 2017 |

Mar 17, 2017 |

Mar 24, 2017 |

|

Mar 5 – Mar 11, 2017 |

Mar 24, 2017 |

Mar 31, 2017 |

|

Mar 12 – Mar 18, 2017 |

Mar 31, 2017 |

Apr 7, 2017 |

|

Mar 19 – Mar 25, 2017 |

Apr 7, 2017 |

Apr 14, 2017 |

|

Mar 26 – Apr 1, 2017 |

Apr 14, 2017 |

Apr 21, 2017 |

|

Apr 2 – Apr 8, 2017 |

Apr 21, 2017 |

April 28, 2017 |

|

Apr 9 – Apr 15, 2017 |

April 28, 2017 |

May 5, 2017 |

|

Apr 16 – Apr 22, 2017 |

May 5, 2017 |

May 12, 2017 |

|

Apr 23 – Apr 29, 2017 |

May 12, 2017 |

May 19, 2017 |

Here is the 2016 tax refund calendar:

|

2016 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Jan 19 – Jan 23, 2016 |

Feb 5, 2016 |

Feb 10, 2016 |

|

Jan 24 – Jan 30, 2016 |

Feb 12, 2016 |

Feb 17, 2016 |

|

Jan 31 – Feb 6, 2016 |

Feb 19, 2016 |

Feb 24, 2016 |

|

Feb 7 – 13, 2016 |

Feb 26, 2016 |

Mar 2, 2016 |

|

Feb 14 – 20, 2016 |

Mar 4, 2016 |

Mar 9, 2016 |

|

Feb 21 – 27, 2016 |

Mar 11, 2016 |

Mar 16, 2016 |

|

Feb 28 – Mar 5, 2016 |

Mar 18, 2016 |

Mar 23, 2016 |

|

Mar 6 – 12, 2016 |

Mar 25, 2016 |

Mar 30, 2016 |

|

Mar 13 – 19, 2016 |

Apr 1, 2016 |

Apr 6, 2016 |

|

Mar 20 – 26, 2016 |

Apr 8, 2016 |

Apr 13, 2016 |

|

Mar 27 – Apr 2, 2016 |

Apr 15, 2016 |

Apr 20, 2016 |

|

Apr 3 – Apr 9, 2016 |

Apr 22, 2016 |

April 27, 2016 |

|

Apr 10 – Apr 16, 2016 |

April 29, 2016 |

May 4, 2016 |

|

Apr 17 – Apr 23, 2016 |

May 6, 2016 |

May 11, 2016 |

|

Apr 24 – Apr 30, 2016 |

May 13, 2016 |

May 18, 2016 |

Here is the 2015 tax refund calendar:

|

2015 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

Direct Deposit Sent |

Paper Check Mailed |

|

Jan 20 – Jan 24, 2015 |

Feb 6, 2015 |

Feb 9, 2015 |

|

Jan 25 – Jan 31, 2015 |

Feb 13, 2015 |

Feb 16, 2015 |

|

Feb 1 – Feb 7, 2015 |

Feb 20, 2015 |

Feb 23, 2015 |

|

Feb 8 – 14, 2015 |

Feb 27, 2015 |

Mar 2, 2015 |

|

Feb 15 – 21, 2015 |

Mar 6, 2015 |

Mar 13, 2015 |

|

Feb 22 – 28, 2015 |

Mar 13, 2015 |

Mar 20, 2015 |

|

Mar 1 – 7, 2015 |

Mar 20, 2015 |

Mar 27, 2015 |

|

Mar 8 – 14, 2015 |

Mar 27, 2015 |

Apr 3, 2015 |

|

Mar 15 – 21, 2015 |

Apr 3, 2015 |

Apr 10, 2015 |

|

Mar 22 – 28, 2015 |

Apr 10, 2015 |

Apr 17, 2015 |

|

Mar 29 – Apr 4, 2015 |

Apr 17, 2015 |

Apr 24, 2015 |

|

Apr 5 – Apr 11, 2015 |

Apr 24, 2015 |

May 1, 2015 |

|

Apr 12 – Apr 15, 2015 |

May 1, 2015 |

May 8, 2015 |

|

Apr 16 – Apr 25, 2015 |

May 8, 2015 |

May 15, 2015 |

|

Apr 26 – May 2, 2015 |

May 15, 2015 |

May 22, 2015 |

Here is the 2014 tax refund calendar:

|

2014 IRS Tax Refund Calendar |

||

|---|---|---|

|

Accepted Date |

Direct Deposit Sent |

Paper Check Mailed |

|

Jan 31 – Feb 3, 2014 |

Feb 13, 2014 |

Feb 21, 2014 |

|

Feb 4 – 10, 2014 |

Feb 21, 2014 |

Feb 24, 2014 |

|

Feb 11 – 17, 2014 |

Feb 28, 2014 |

Mar 3, 2014 |

|

Feb 18 – 24, 2014 |

Mar 7, 2014 |

Mar 10, 2014 |

|

Feb 25 – Mar 3, 2014 |

Mar 14, 2014 |

Mar 17, 2014 |

|

Mar 4 – 10, 2014 |

Mar 21, 2014 |

Mar 24, 2014 |

|

Mar 11 – 17, 2014 |

Mar 28, 2014 |

Mar 31, 2014 |

|

Mar 18 – 24, 2014 |

Apr 4, 2014 |

Apr 7, 2014 |

|

Mar 25 – 31, 2014 |

Apr 11, 2014 |

Apr 14, 2014 |

|

Apr 1 – 7, 2014 |

Apr 18, 2014 |

Apr 21, 2014 |

|

Apr 8 – 14, 2014 |

Apr 25, 2014 |

Apr 28, 2014 |

|

Apr 15 – 21, 2014 |

May 2, 2014 |

May 5, 2014 |

|

Apr 22 – 28, 2014 |

May 9, 2014 |

May 12, 2014 |

Frequently Asked Questions About Tax Refunds

Here are some of the most common questions and FAQs around this tax refund calendar and tax refund schedule:

When will I get my tax refund in 2026?

Most refunds arrive within 21 days of e-file acceptance. Returns with EITC/ACTC are held until at least mid-February, with most direct deposits by March 6.

How do I check my tax refund status?

You can check your tax refund status for your federal tax return on the IRS Refund Status page. You can check your state tax refund on your state’s tax refund status page.

What does it mean when your refund is pending with the IRS?

If your refund status says “Pending”, this means that your tax return is in progress.

How long can the IRS hold your refund?

The IRS can technically hold your refund as long as necessary to resolve any issues with your tax return. However, most people see a hold resolved within 21 days of the IRS receiving the requested information from an additional review (such as identity verification).

What if I filed EITC or ACTC?

If you have the Earned Income Tax Credit or Additional Child Tax Credit, your refund does not start processing until February 15. Your 21 day average starts from this point – so you can usually expect your tax refund the last week of February or first week of March.

How long does it take to process a return sent by mail?

If you mailed your tax return, allow twelve weeks for processing, then your 21 day period starts once your tax return is in the IRS system.

What if I get Tax Topic 152?

Tax Topic 152 simply means you’re getting a refund! Sit back, relax, and wait for that direct deposit or check to come!

What if I get Tax Topic 151?

This means you have a tax offset. Some or all of your refund is being garnished. Read our full guide to this here.

Final Thoughts

One of the best ways we keep track of what’s happening with tax refunds during tax season is your comments and feedback. Please drop a comment below and share your refund dates so others can know!

Editor’s Note: This article is updated continuously throughout tax season as the IRS releases new information. Data is based on prior IRS cycles, agency announcements, and user-reported refund timelines.

Editor: Colin Graves

Reviewed by: Ohan Kayikchyan Ph.D., CFP®

The post IRS Tax Refund Calendar And Schedule 2026 (Updated) appeared first on The College Investor.