Tech stocks are getting slammed right now.

Although the stock market has sold off a bit, it’s really not as bad as some people think. A few negative days in a row may be worrisome, but the S&P 500 is only down a couple of percentage points from its all-time high, so to call this a full-blown market sell-off isn’t accurate.

Now, if you want to rebrand it to a tech stock sell-off, that’s more like it. Many tech stocks are down significantly from their recent highs, but most don’t have a great reason to be there. I think these are the best stocks to buy now, and I’ve got three on my shopping list. I think each of these stocks will deliver excellent returns over the next few years, and should be bought hand over fist right now.

Image source: Getty Images.

Microsoft

Microsoft (MSFT +0.03%) was once the premier artificial intelligence (AI) stock to own. Its Azure cloud computing server powered several AI workloads, including those for ChatGPT. While it still does that and is delivering excellent results (Azure revenue rose 39% year over year), the market seems to want more. Apparently 17% companywide revenue growth to $81.3 billion and operating income increasing 21% to $38.3 billion just isn’t enough.

I think the market has gotten a bit greedy about what it expects from big tech, and it will eventually come back around to valuing Microsoft at the higher premium it should trade at.

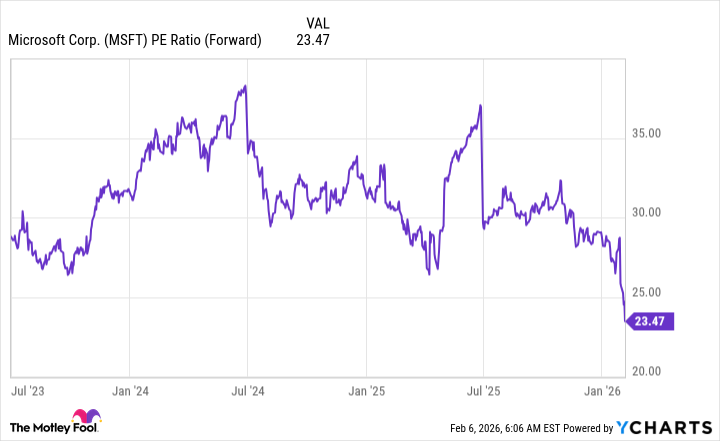

MSFT PE Ratio (Forward) data by YCharts

This is the lowest forward price-to-earnings ratio Microsoft has traded at over the past three years, and now is the time to make a move on it and scoop it up for cheap.

Today’s Change

(0.03%) $0.10

Current Price

$404.47

Key Data Points

Market Cap

$3.0T

Day’s Range

$402.41 – $405.31

52wk Range

$344.79 – $555.45

Volume

99K

Avg Vol

31M

Gross Margin

68.59%

Dividend Yield

0.84%

Nvidia

If you think Microsoft is doing well and looks like a bargain, then you’re going to love Nvidia (NVDA +1.43%). Nvidia trades for a mere 24 times forward earnings — not much more than the S&P 500, which trades at 21.8 times forward earnings. With those valuation levels, you may think that Nvidia’s growth is done, but that’s far from the case.

Just this week, investors learned that Amazon will spend $200 billion on capital expenditures, Alphabet will spend up to $185 billion, and Meta Platforms will spend up to $135 billion. That’s over $500 billion in capital expenditures from just three companies, and Nvidia will receive a nice chunk of that revenue.

Wall Street analysts project 52% growth for fiscal 2027 (ending January 2027). When is the last time you could buy a stock with a clear bull case that’s growing at a greater than 50% rate and is trading at a market-average valuation? It’s a rare opportunity, and investors should buy Nvidia stock as a result.

Today’s Change

(1.43%) $2.71

Current Price

$192.76

Key Data Points

Market Cap

$4.6T

Day’s Range

$191.85 – $193.61

52wk Range

$86.62 – $212.19

Volume

353K

Avg Vol

180M

Gross Margin

70.05%

Dividend Yield

0.02%

Taiwan Semiconductor Manufacturing

Those AI hyperscalers have other computing unit options to select from, so not all of that pile of money will go toward Nvidia. However, whichever computing chip they select will likely have chips from Taiwan Semiconductor Manufacturing (TSM +1.04%) in it, as it’s the world’s leading chip foundry. Companies like Nvidia don’t fabricate any chips; they just design them. Taiwan Semiconductor is the primary chip producer, and its revenue dwarfs other foundries around the world.

Taiwan Semiconductor likewise expects strong growth in 2026, with management guiding for nearly 30% revenue growth in U.S. dollars this year. However, AI chips are expected to deliver particular growth, as management believes AI chip revenue will grow at nearly a 60% compound annual growth rate (CAGR) between 2024 and 2029. That projection conveys strength not only for Taiwan Semiconductor but also for Nvidia, which is a major driver of that demand.

Taiwan Semiconductor Manufacturing

Today’s Change

(1.04%) $3.91

Current Price

$378.00

Key Data Points

Market Cap

$1.9T

Day’s Range

$374.50 – $379.23

52wk Range

$134.25 – $379.58

Volume

100K

Avg Vol

13M

Gross Margin

59.02%

Dividend Yield

0.82%

As the recent capital expenditure budgets for the hyperscalers indicate, we’re still in the early innings of AI deployment. There is still plenty of growth to go, and these three stocks are genius ways to capitalize on the build-out.

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.