This ETF pays an attractive and steadily rising stream of passive dividend income.

Generating passive income is a big part of my investment strategy. It provides me with more cash to invest and helps me become more financially independent.

I’ve found that investing in exchange-traded funds (ETFs) is a great way to complement my passive income investment strategy. One of my favorite ETFs to buy for income is the Schwab U.S. Dividend Equity ETF (SCHD 0.85%). Here’s why I plan to buy even more of the high-yield ETF this November.

Image source: Getty Images.

A simple way to invest in 100 top dividend stocks

The Schwab U.S. Dividend Equity ETF tracks an index (the Dow Jones U.S. Dividend 100 Index) that measures the performance of 100 of the highest-quality dividend stocks. It screens companies based on several dividend quality characteristics, including dividend yield and five-year dividend growth rate. It also selects companies based on their financial strength compared to their peers.

The fund’s holdings have an average yield approaching 4% and have grown their payouts at a more than 8% compound annual rate over the past five years. As a result, it provides investors with a nice current income stream that steadily rises, a great combo for those seeking to generate passive income. At its current annualized dividend rate, I can generate nearly $40 of annual passive income from every $1,000 I invest in the fund.

Schwab U.S. Dividend Equity ETF

Today’s Change

(-0.85%) $-0.23

Current Price

$26.93

Key Data Points

Market Cap

$0B

Day’s Range

$26.81 – $27.07

52wk Range

$23.87 – $29.72

Volume

18M

Avg Vol

0

Gross Margin

0.00%

Dividend Yield

N/A

The cream of the dividend income crop

The ETF holds a who’s who of elite dividend stocks. For example, one of its top ten holdings is PepsiCo (PEP 1.13%). The beverage and snacking giant’s dividend currently yields 3.9%, well above the S&P 500‘s 1.2% yield. The company generates lots of durable cash flow to support its dividend and also has a strong balance sheet. PepsiCo has increased its dividend for 53 straight years, qualifying it as a Dividend King, a company with 50 or more years of annual dividend increases. The iconic company has grown its dividend at an impressive 7.5% compound annual rate since 2010.

Today’s Change

(-1.13%) $-1.68

Current Price

$147.09

Key Data Points

Market Cap

$201B

Day’s Range

$146.69 – $148.79

52wk Range

$127.60 – $165.13

Volume

206K

Avg Vol

7.6M

Gross Margin

54.21%

Dividend Yield

0.04%

The fund’s top 10 holdings feature several other high-quality, high-yielding dividend stocks. Notable names include Coca-Cola (2.9% current yield and 63 consecutive years of dividend increases), Chevron (4.5% current yield and 38 years of dividend growth), and Verizon (7.7% current yield and 19 straight years of dividend increases). In essence, the fund enables investors to hold a diversified portfolio of some of the world’s best higher-yielding dividend stocks.

Income growth and attractive total return potential

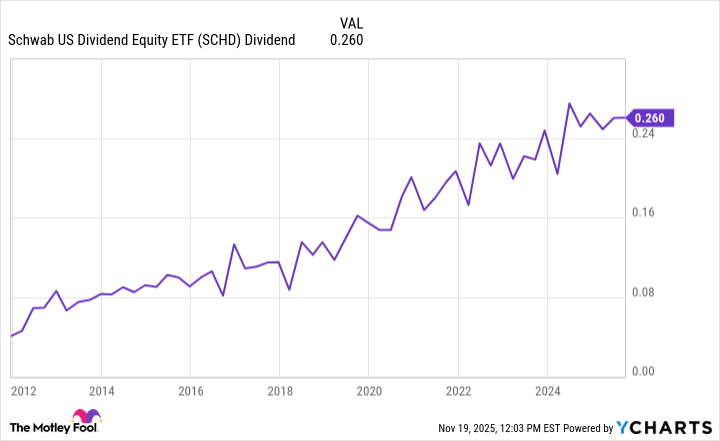

The Schwab U.S. Dividend Equity ETF provides investors like me with more than just an attractive current passive income stream. The fund doesn’t just hold high-yielding dividend stocks; it holds companies that steadily increase their payments. As a result, the income stream provided by this ETF steadily increases:

That growth has two notable benefits. Investors collect more income each year. Additionally, they benefit from value appreciation. As the underlying companies grow their earnings and increase their dividends, their share prices tend to rise accordingly. That combination of income and price appreciation provides investors with a high total return.

Since its inception in 2011, the Schwab U.S. Dividend Equity ETF has produced an 11.6% average annual total return. It has also delivered a more than 10% average annualized total return over the past three-, five-, and 10-year periods.

Passive income and more

The Schwab U.S. Dividend Equity ETF is a perfect fund to buy for passive income. It offers a high-yielding income stream backed by 100 of the world’s best dividend stocks. These companies also have excellent track records of increasing their dividends and shareholder value. As a result, investors will collect an attractive and steadily rising stream of income while also growing their wealth. Those features are why I’m buying even more of this top high-yield ETF in November.

Matt DiLallo has positions in Chevron, Coca-Cola, PepsiCo, Schwab U.S. Dividend Equity ETF, and Verizon Communications. The Motley Fool has positions in and recommends Chevron. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.