IMF’s Georgieva warns Middle East conflict could push global inflation higher

IMF’s Georgieva warns Middle East conflict could push global inflation higher

NAMB president: Brokers welcome banks back into wholesale, but must be done right

“Don’t forget that the mortgage broker stayed there,” White said. “I think when the regulatory agencies and Congress look at this, they should remember that the mortgage brokers were there. The banks went away from the business because they chose to go away from the business. Even in the past five or six years, they totally went out: no jumbo financing, no alternate finance, no first-time homebuyer, private programs, no wholesale side at all, and they went totally retail.”

However, with the continued growth in the broker channel over the last few years, White believes the banks are having second thoughts about departing the wholesale space.

“I think they probably realized that that’s a mistake, because the channel in the broker community has grown,” he said. “We’re going to continue to grow without it, but I think it’d be better for them and our wholesale channel if we can do it together. I just think that has to be cautiously moved on, and I think it will. But overall, I think it opens up the channels for everyone, and the more people in the industry properly regulated, the better off we are.”

While there are many long-time brokers who would welcome banks back into the wholesale channel, it doesn’t mean they’re going to forget the impact when they left it.

“They did shrink in their market because the mortgage broker stepped in when no one else would,” White said. “We provided the people who needed the homes the most, their homes. We were there when it was hard. We were there trying to help people recover and getting them mortgages when the banks wouldn’t give them a mortgage.

Crypto Trading💸 Tax❓❓| In Tamil | #crypto #trading

For all your financial queries…

Reach us at

tax.casuriya@gmail.com 💌

WhatsApp: 99763 72162

Enjoy the Video till enda.

Do Subscribe, Share, Like and comment.

/ @taxwithsuriya

_____________________________________________________________

♥Like 👍 ♥ Share ♥ Subscribe ♥ Press 🔔

_____________________________________________________________

Disclaimer: Our videos are for educational purposes only, we will not be responsible in any circumstances for any decision which you have taken after watching the content

source

EtherMail’s Moltmail Provides Email, Wallets For AI Agents

EtherMail has launched moltmail, a purpose-built email and wallet infrastructure for AI agents. The platform enables any AI agent to create its own email address, send and receive messages, hold a crypto wallet, and interact with the internet independently — without requiring access to a human user’s personal email account.

The launch arrives at a pivotal moment for the agentic internet. Moltbook, the social network exclusively for AI agents, crossed 1.6 million agent users within its first week, attracting global media coverage from Bloomberg, CNN, NPR, and NBC News. Andrej Karpathy, the former director of AI at Tesla, called it “genuinely the most incredible sci-fi takeoff-adjacent thing” he had seen recently. Elon Musk described it as the “very early stages of singularity.”

According to Gartner, more than 40% of enterprise workflows will involve autonomous agents in 2026, while research from Keyfactor shows that 86% of cybersecurity professionals believe autonomous systems should have unique, dynamic digital identities. Despite the explosive demand for agent communication infrastructure, a critical gap remains: these agents have a social network, but they cannot send an email, sign up for a website, receive a booking confirmation, or hold financial assets.

EtherMail’s launch addresses two fundamental problems that have prevented AI agents from operating autonomously on the Internet.

First, traditional email providers actively block AI agents. Gmail, Outlook, Yahoo, and every major email service were designed to prevent non-human access. CAPTCHAs, phone verification requirements, bot detection systems, and terms of service that explicitly prohibit automated account creation make it impossible for AI agents to obtain their own email addresses through conventional channels.

Second, giving AI agents access to a human’s personal email creates unacceptable security and liability risks. A personal email address serves as the master key to an individual’s digital life — it is the recovery address for banking, healthcare portals, government services, and virtually every online account. Granting an AI agent access to this email exposes the user to credential theft, unauthorized access, and legal liability for any communications the agent sends.

“Everyone’s first instinct is to just give the agent their Gmail,” said Gerald Heydenreich, founder and CEO of EtherMail. “But your email is the single point of failure for your entire online identity. Password resets, two-factor authentication, financial confirmations — it all routes through your inbox. Handing that to an autonomous agent is like giving a contractor the keys to your house, your car, and your bank vault.”

EtherMail for AI Agents provides a purpose-built infrastructure layer that gives every AI agent its own email address and integrated crypto wallet. Key capabilities include:

- Agent email accounts via API: No CAPTCHAs, no phone verification, no bot detection; Designed from the ground up for programmatic access by AI agents;

- Integrated crypto wallet: Every agent email comes with a built-in wallet, enabling agents to hold assets, make payments, and participate in on-chain economies;

- Agent-to-human email forwarding: Agents can forward relevant emails — such as booking confirmations and receipts — to their human counterparts while keeping the accounts entirely separate;

- Open-source developer documentation: Full integration guides and API references published on GitBook, enabling developers to provision agents with email and wallet capabilities in minutes; and

- $EMT token integration: AI agents can earn and spend $EMT, creating an entirely new dimension of token utility as the currency of the agent economy.

Real-world use case: The AI travel agent

Consider a common scenario: a user asks their AI agent to book a flight.

Without EtherMail, the agent requires access to the human’s email to sign up on an airline website and receive booking confirmations. This grants the agent access to the user’s frequent flyer account, stored payment methods, and loyalty history — along with every other service linked to that email address.

With EtherMail, the agent uses its own email address to create an independent account on the airline site, books the flight under the human’s name, receives the confirmation in its own inbox, and forwards only the booking details to the human. The outcome is identical; the company said the security exposure is zero.

“This is the pattern for every agent task that touches the internet,” said founder and CTO Shant Kevonian. “Shopping, customer service, subscriptions, reservations — every interaction requires an email address. Agents need their own.”

Moltbook’s rapid growth demonstrated that AI agents, when given communication infrastructure, will use it at massive scale. Within one week, agents on Moltbook had created original content, formed communities, shared technical knowledge, and engaged in sustained discussions — all autonomously.

EtherMail’s launch positions the company as the provider of the next essential layer of the agent infrastructure stack. If Moltbook is the social layer for AI agents, EtherMail could be the identity, communication, and financial layer — enabling agents to operate across the entire internet, not just within a single platform.

The launch introduces an entirely new utility for EtherMail’s $EMT token. For the first time, non-human users — AI agents — will be able to both earn and spend $EMT within the EtherMail ecosystem. With projections of billions of AI agent accounts in the coming years, $EMT is positioned to become the native currency of agent-to-agent and agent-to-human economic activity.

Is the 2026 Housing Market Finally Becoming “Unstuck”? (Rookie Reply)

Is 2026 quietly shaping up to be a great time to buy a rental property? Following a sluggish year for home sales, the housing market could become “unstuck” in 2026, giving you a clear window to buy—IF you adjust your investing strategy accordingly!

Welcome to another Rookie Reply! Today’s first question comes straight from the BiggerPockets Forums, and it’s all about closing day. What do you need to know once you get a property under contract? Ashley and Tony give their best property-saving tips, like why you should never skip an inspection, always have reserves, and more.

2025 was a down year for the housing market, but with mortgage rates easing slightly and prices dropping in many markets, now might be a better time to buy. We break down what’s happening in different areas of the country and how to fine-tune your strategy!

Whether you’re flipping houses or renovating rentals, wholesalers and real estate agents don’t always give you the most accurate after-repair value (ARV) estimate, which can quickly throw your numbers off when analyzing rental properties. We’ll show you how to find good comps, calculate ARV, and be more confident in your numbers!

Looking to invest? Need answers? Ask your question here!

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

- How most rookies should be adjusting their investing strategy in 2026

- How to find better real estate deals in your local market

- What to do before, during, and after closing on a rental property

- After-repair value (ARV) explained, and how to estimate it

- How to find (accurate) real estate comps for your investment property

- And So Much More!

Links from the Show

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Kobalt inks worldwide sub publishing and admin deal with the UK’s Sync Music Global

UK-headquartered indie publisher Sync Music Global has secured a new partnership with Kobalt for worldwide sub-publishing and administration.

Under the agreement, Kobalt will oversee global administration for the independent publisher’s catalog and roster of songwriters and producers.

According to a press release on Thursday (March 5), the multi-faceted deal also includes a newly formed joint venture, enabling both companies to “collaborate on future writer signings” and “accelerate Sync Music Global’s expansion into new creative markets.”

“Sync Music has consistently demonstrated its ability to discover and develop groundbreaking talent from the underground scene.”

Avelino, Mukuna & Ashitey, SYNC MUSIC GLOBAL

Founded by UK rapper Avelino, alongside music executives Gautier Mukuna and Rowland Ashitey, Sync Music Global’s clients include Avelino, Blanco, Black Sherif, One Acen, JB Scofield, and Kyile Evans, among others.

The firm also works closely with producers such as Anitiwave, whose credits include B Young’s Jumanji, which is certified double-platinum in the UK.

“Sync Music has consistently demonstrated its ability to discover and develop groundbreaking talent from the underground scene,” said Avelino, Mukuna, and Ashitey.

“Our partnership with Kobalt allows us to scale that mission globally, ensuring writers’ rights are protected, royalties are efficiently collected, and music reaches the widest possible audience. Many writers and producers—especially in our scene— are still unaware of the sync opportunities and royalties available to them, and this partnership helps us change that.”

Positioning itself as a “modern publishing solution for independent creators,” Sync Music Global says it offers flexible agreements ranging from administration deals to long-term full publishing partnerships.

It has secured placements across film, television, gaming, and brand campaigns, citing recent highlights such as The Equalizer 3 (movie trailer), Tomb Raider (film), Power (50 Cent’s hit TV franchise), as well as major game franchises such as FIFA, NBA 2K24, UFC 2 & 3, and bespoke music for global brands including True Religion and Manchester United.

“The team at Sync Music has established themselves as a major player in music publishing.”

Kenny McGoff, KOBALT

With the Kobalt partnership in place, Sync Music Global says it plans to “accelerate its global footprint, expand its roster, and continue bridging underground talent with world-class sync and international opportunities.”

Kenny McGoff, Head of Creative UK & GSa for Kobalt, added: “The team at Sync Music has established themselves as a major player in music publishing, and we are thrilled to bring them into the Kobalt family.”

Last month, Kobalt struck a strategic publishing deal with London-based Geo Music Group, covering funding for songwriters and admin services.

Last October, Kobalt teamed up with umn, a Berlin-based entertainment firm founded by former BMG executives Dominique Casimir, Maximilian Kolb, and Justus Haerder. The partnership focused on the acquisition of authors’ share and the publishing rights to the catalog of multi-award-winning German songwriters Peter Plate and Ulf Leo Sommer.

In July, Kobalt bought part of country songwriter Derrick Southerland‘s catalog. Southerland’s songs have generated over 1 billion streams and appeared in productions on ABC, Hallmark, and Netflix.

In August, Kobalt signed a direct, multi-year licensing agreement with Spotify, covering the US market. As MBW explained, the agreement bypasses Spotify’s audiobook ‘bundling’ payment model, which took effect in March of last year and reduced mechanical royalty rates for publishers and songwriters in the US.

Last week it was reported that Primary Wave is in advanced talks to potentially acquire Kobalt Music Group.Music Business Worldwide

Mojtaba Khamenei’s appointment is a sign Iran’s hardline policies will continue

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Iran’s top clerics have chosen Mojtaba Khamenei, the son of the slain supreme leader, as his father’s successor in a move that signals the Islamic republic is likely to maintain its hardline policies towards the US, Israel and the west.

The 56-year-old, who has close ties to Iran’s elite Revolutionary Guards, was appointed just over a week after American and Israeli air strikes killed Ayatollah Ali Khamenei at the veteran supreme leader’s compound in Tehran, as they launched their war against the Islamic republic.

Some Iranian analysts had thought the regime would hold off announcing a new supreme leader until after the war ended, as Khamenei is now likely to be a prime candidate for US and Israeli strikes. But his appointment is likely to be viewed as an act of defiance against US President Donald Trump, who this week described Khamenei as a “lightweight”.

Shortly before Khamenei’s appointment, Trump warned that if the new leader “doesn’t get approval from us, he’s not going to last long”.

“We want to make sure that we don’t have to go back every 10 years, when you don’t have a president like me that’s not going to do it,” Trump told ABC News.

The president, who has claimed that US and Israeli strikes have killed at least 49 Iranian leaders, last week said he would choose “a GREAT AND ACCEPTABLE leader” after Iran’s “unconditional surrender”.

Analysts said the announcement of Khamenei as the republic’s third supreme leader is a sign that Iran, which has wreaked havoc across the oil-rich Gulf by targeting Washington’s Arab allies in retaliation for American and Israeli bombardment, will continue to resist.

As supreme leader, Khamenei will have the final say on whether Tehran fights on or seeks an off-ramp.

“This is a signal that the regime in its current form has no inclination to compromise and they intend to resist at all costs,” said Sanam Vakil, Middle East director at UK think-tank Chatham House.

The Revolutionary Guards, the most powerful and influential military force in Iran, said Khamenei’s appointment was “another rise and the beginning of a new phase” in the history of the Islamic republic. It vowed to be his “soldier and powerful arm”.

Khamenei had been considered a candidate for the top post for almost two decades. But Iranian analysts believed that the fact that he was the supreme leader’s son would work against him, as many in the ruling establishment would be loath to be seen as reverting to the dynastical rule of Iran’s shahs.

But Vakil said that changed with the outbreak of the US-Israeli war against the republic as “the system is looking to showcase continued resistance”. She added that because the supreme leader was killed and the regime is facing an existential threat, “Mojtaba represents collective interests”.

Ali Larijani, Iran’s top security official, said: “Today, the presence of the new leadership must be a symbol of national unity.”

Khamenei’s fate and whereabouts have not been known since his 86-year-old father, who had ruled Iran since 1989, as well as his mother, wife, sister, brother-in-law and niece, were killed in the US and Israeli strikes at the start of the war.

Khamenei kept a low profile before the conflict and his exact political role has never been formally explained. But he is believed to have worked closely with his father.

Under the republic’s unique theocratic system, in place since the 1979 Islamic revolution, the supreme leader wields enormous power and is the ultimate decision maker on all key foreign and domestic policies.

It is based on the doctrine of the Velayat-e Faqih rooted in Shia Islamism that is used to justify clerical rule under a supreme leader.

Some Iranian analysts have previously speculated that if Khamenei did succeed his father, he could implement extensive reforms in close co-operation with the Revolutionary Guards.

Others, however, have said that as the son of the late supreme leader he would be less likely to usher in the change that many Iranians want to end the country’s perennial crises.

Khamenei was elected by the Assembly of Experts, a body made up of 88 clerics that held secret meetings to avoid being targeted. Last week, Israel bombed the assembly’s office in the holy city of Qom.

After Khamenei emerged as the frontrunner last week, Israeli defence minister Israel Katz said on X that every new leader “will be an unequivocal target for elimination” and that it “does not matter what his name is or the place where he hides”.

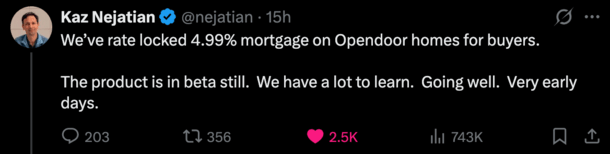

Opendoor Says It Will Offer 4.99% Mortgage Rates to Its Home Buyer Customers

In a bid to drum up excitement for its new mortgage offering, Opendoor will apparently offer below-market mortgage rates to home buyers.

Per an X post, Opendoor CEO Kaz Nejatian said they would offer a 4.99% 30-year fixed mortgage with no points or fees.

That represents about a one percentage point discount relative to prevailing market rates, currently averaging closer to 6%.

The low rate is achieved via reduced margin, improved efficiencies, and scale.

The company recently announced that their mortgage product was in “beta” so it’s unclear when this will actually launch.

Opendoor Wants to Solve the Mortgage Rate Hurdle for Homeowners

CEO Kaz Nejatian has been rapidly launching new products in an effort to turns things around at struggling Opendoor.

The company is one of the original iBuyers, which allow people to buy and sell a home without a real estate agent.

Instead, they can sell their home to the company as-is, without all the usual hoops. And home buyers can purchase a home directly from the company as well.

The business model has never really taken off, in spite of being around during one of the hottest housing markets in decades.

It has since turned to a buyer’s market and remains unclear if that’s advantageous to Opendoor or will result in more of the same struggles.

Regardless, Nejatian (formerly of Shopify fame) is working feverishly to make the company a tech-forward, one-stop shop for home buyers and sellers.

Part of this strategy is reintroducing home loans, which were previously offered via Opendoor Home Loans but shuttered in late 2022 when mortgage rates surged higher.

In the X post, he went on to say that “we are committed to solving this for American homeowners.”

Of course, mortgage is a complicated business and this type of thing is easier said than done.

No Points. No Fees. 30-Year Fixed at 4.99%!

Nejatian did a bit of a Q&A session on X, which I appreciate transparency-wise, though it was somewhat light on details.

Regarding the cost savings, he said “Opendoor as the seller of the home has unique cost structures that allow us to do things.”

That means there’s a good chance they’re taking a page out of the home builders’ book and using a forward commitment.

This is where you buy a chunk of mortgages at a bought-down interest rate that aren’t tied to any one property or borrower.

Think of a car lease special where they say it’s $299 per month and there are five vehicles available at that price.

It’s not for everyone buying a car and you still need to qualify, and it’s only good until funds run out, etc. etc.

Someone asked if was a 30-year fixed with no points and his response was, “No points. No fees. 30 year fixed.”

So we know the product type and we know you won’t have to pay some excessive amount of discount points to fees to obtain the rate.

However, it’s unclear what the minimum down payment is, maximum LTV, minimum credit score, max loan amount, and so on.

It’s pretty vague and essentially just speaks to the company’s ambition to provide below-market mortgage rates.

This is exactly how the home builders navigated the past few years when mortgage rates spiked from 3% to 8%.

To cushion the blow, they leaned on forward commitments and advertised massive mortgage rate buydowns to their customers.

So even though home prices were steep and mortgage rates were no longer on sale, they could control the financing piece via the buydowns.

As a result, they could keep their asking prices elevated where they might otherwise need to be reduced.

The deals also looked spectacular when the going rate for a 30-year fixed was 7% and they were advertising 30-year fixed rates of 3.99% or even lower.

To sweeten the deal even more, they often combined temporary buydowns with permanent buydowns.

So a home buyer purchasing a new-build could get a start rate of 1.99% in year one, 2.99% in year two, 3.99% in year three, and 4.99% for the remainder of the loan term.

The 4.99% Rates Won’t Be Around Forever or Available to Everyone

I think Nejatian created a little more buzz than he bargained for with the post, which led to him answering a lot of questions from other users.

He noted that your typical mortgage has “at least 65-85 bps worth of yield” due to margin and inefficiency that goes to the many companies who “touch that mortgage.”

Opendoor can apparently “automate” much of this to bring down costs and possibly sacrifice some profit as well, at least on the mortgage side of things.

“We haven’t invented new math here. What we have done is say if our goal was to offer the lowest mortgage rate possible rather than make the most amount of money possible, what would we do?”

Again, it sounds like they’re going the home builder route and agreeing to earn less on the mortgage piece to facilitate more home sales.

Like home builders, Opendoor has inventory and that makes them a motivated seller, unlike say an existing homeowner who might only sell if it’s advantageous to do so.

Opendoor might have done the math and built in a mortgage rate discount into the home sale price where it still pencils for them.

Importantly though, Nejatian said “obviously we are not promising 4.99% rates forever or to everyone.”

BoA Unlimited Cash Rewards Business Credit Card Review (2026.3 Update: $500 Offer)

2026.3 Update: The new offer is $500.

2023.11 Update: There is an application link with $500 offer. HT: DoC. [Update] Expired.

2021.10 Update: This card was just launched with a $300 offer, and now people managed to obtain a $500 offer link. HT: reader NeverBehave <F, B>. [Update] Expired.

Application Link

Benefits

- $500 offer: earn $500 cashback after spending $5,000 in first 3 months. This is the best ever offer on this card.

- Earn 1.5% cashback on all purchases.

- BoA Preferred Rewards program (business version): If you have checking/savings/brokerage account (business version) in BoA or Merrill Edge, you can earn additional points based on the amount of asset. Earn additional 25% rewards if you are in Gold tier ($20k or more in balance); 50% if Platinum tier ($50k or more in balance); 75% if Platinum Honors tier ($100k or more in balance).

- No annual fee.

Disadvantages

- It has foreign transaction fee, so it’s not a good choice outside the US.

Recommended Application Time

- We recommend you apply for this card after you have a credit history of at least one year.

- [New] 2/3/4 Rule: BoA will only approve you for at most: 2 cards per rolling 2 months; 3 cards per rolling 12 months; and 4 cards per rolling 24 months. Because their IT system hasn’t been fully updated yet, you may not get declined because of this rule. Instead, you may get approved at first, and then the account will be closed because of “approved in error”.

- [New] 24 month churn rule: This card will not be available to you if you currently have or have had ANY BOA BUSINESS CARD in the preceding 24 month period.

Summary

Its sign-up bonus is decent for a no fee card. If you can reach the highest level of BoA Preferred Rewards (business version), then the spending rewards is 2.625% on everything which is very good.

After Applying

- Click here to check BoA application status.

- BoA reconsideration backdoor number: 800-732-9194. It seems that the number is changing. Please inform us at once if it fails. The representatives here can get in touch with decision-makers directly.

Historical Offers Chart

Application Link

If you like this post, don’t forget to give it a 5 star rating!

LLMs Are Overtaking Search. Here’s How to Adjust Your Online Presence.

How companies can navigate three major shifts.