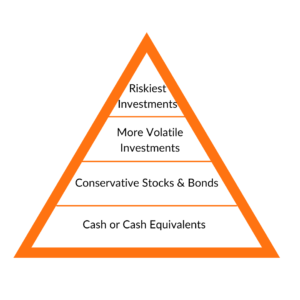

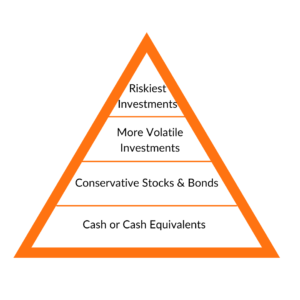

Let me introduce you to the Investment Pyramid. Understanding this pyramid was a game changer for me.

Decades ago, a wealthy family friend urged me to invest in a Limited Partnership, calling it a “an exciting opportunity.”

I didn’t know that a Limited Partnership was illiquid and I couldn’t sell my shares, even as I watched the company go bust.

When I told my accountant this story, he drew a triangle, divided it into 4 levels, explaining this represented the whole world of investing. My mistake was starting at the top.

He then drew an upside down triangle, resting on it’s wobbly tip. “See what happens when you start at the top,” he explained. “Your portfolio is not very stable is it?”

My accountant had just given me the secret to investing wisely: start at the bottom and work your way up, level by level.

Level #1: Cash or cash equivalents (CDs, treasuries, money market funds, basic bank accounts). This is your safety net. You’ve got cash to cover the unexpected, without slipping into debt. There’s little volatility, so you’re not likely to lose sleep worrying. The risk: inflation.

your safety net. You’ve got cash to cover the unexpected, without slipping into debt. There’s little volatility, so you’re not likely to lose sleep worrying. The risk: inflation.

Level #2: Conservative stocks and bonds (solid companies, high-rated bonds, funds with good track records.) This level fluctuates more than, say, treasuries, but is very liquid and the returns are high enough to offset inflation. The risk: needing to sell in a down market

Level #3: More Volatile Investments (Emerging Markets, Foreign Funds, Junk bonds). Appropriate for a small portion of your portfolio, since price swings can be extreme but sure can ratchet up your returns. However, you’ll need a strong stomach and a longer time frame. The risk: severe volatility

Level #4: Riskiest Investments (Limited Partnerships, Venture Capital, Hedge Funds, Options, Commodities). Gains here can be enormous, but so can the losses, leading to huge fortunes or sudden bankruptcy. The risk: ultra high.

Entrepreneurs, guess where your business fits? At the very top. I worry when women tell me their largest, and sometimes their sole, investment is in their own company.

I urge everyone to make sure they have a solid foundation of cash in the bank and a healthy retirement fund before they plough capital into their own companies.

How do your investments stack up? Are you on stable ground or do you need to reassess? Share your thoughts in a comment below.

Barbara Huson is the leading authority on women, wealth and power. As a bestselling author, financial therapist, teacher & wealth coach, Barbara has helped millions take charge of their finances and their lives. Barbara’s background in business, her years as a journalist, her Master’s Degree in Counseling Psychology, her extensive research, and her personal experience with money give her a unique perspective and makes her the foremost expert on empowering women to live up to their financial and personal potential.

Barbara is the author of 7 books, her newest, Rewire for Wealth, was published in 2021. You can learn more about Barbara and her work at www.Barbara-Huson.com.

your safety net. You’ve got cash to cover the unexpected, without slipping into debt. There’s little volatility, so you’re not likely to lose sleep worrying. The risk: inflation.

your safety net. You’ve got cash to cover the unexpected, without slipping into debt. There’s little volatility, so you’re not likely to lose sleep worrying. The risk: inflation.