A common question we see every year is “can you take out more student loan debt than you need?” It sounds crazy, but some people want to take advantage of the low fixed costs and loan forgiveness options than may come in the future.

With the rising costs of tuition, fees, and college living expenses, financing a college education is becoming increasingly difficult.

The fact remains that many students will apply for student loans. And while loans provide essential financial support, they come with significant responsibility and long-term implications.

So how much do you really need? How much should you accept? And should you borrow more than you need?

Making informed financial decisions now can truly set yourself up for success later, and student loans are a great example of this. So read on to start building good financial habits!

Recent Trends In Student Loan Debt

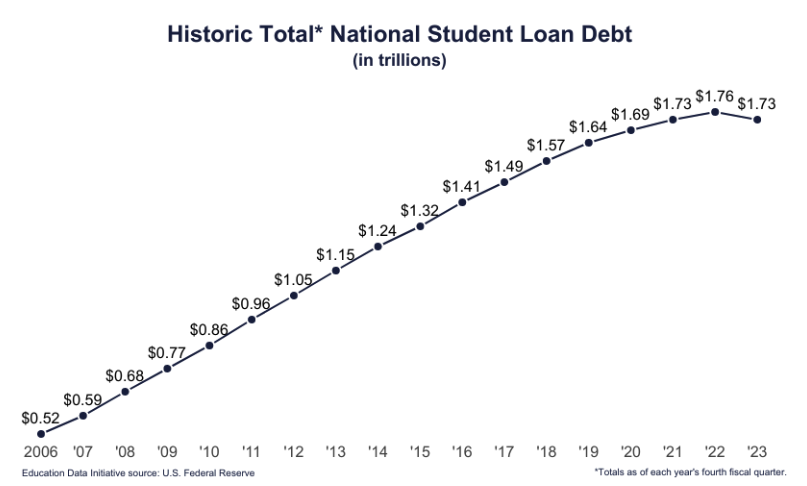

Student loan debt has grown tremendously over the last two decades and is now one of the top types of consumer debt across the country. This shouldn’t come as a surprise when you learn that the cost to attend college has more than doubled in the past four decades.

Who sets the price of tuition anyway? In many cases, the institution’s local governing board sets tuition rates. But there has also been an increased demand for college education across the board. These factors, combined with less government funding and increasing overhead costs, contribute to higher costs for you to pursue higher education.

Student loan debt in the US comes out to $1.7 trillion. And while the most recent years have actually experienced a slight decline in student loan debt, more than half of our students continue to graduate with loan debt. In fact, the current average student debt balance is $37,718, and the average US household owes $55,347 in student debt. Excuse my pun, but it really pays to know what you’re agreeing to when you sign for your student loans.

Related:

How Student Loans Work

Factors That Add To Student Loan Debt

Several factors contribute to students taking out more loans than they need. And it doesn’t help that lenders often offer more than enough to cover tuition expenses. Here are some influencing factors to keep in mind so you can borrow responsibly:

Overestimating Your Expenses: Students tend to overestimate their college expenses when they don’t know the true cost of attendance, misjudge living expenses, or forget to consider additional income or cost-saving opportunities.

Social and Peer Pressure: Just like in other aspects of life, peer pressure can play a significant role in your borrowing decisions due to the desire to fit in, maintain the same lifestyle as friends, and keep up with new spending habits.

Limited Financial Aid: There may be a number of reasons you find yourself unable to qualify for federal grants, university scholarships, or other forms of financial aid and, instead, turn to student loans to fill the financial gap.

Misinformation: There are a whole host of marketing tactics used by lenders to encourage students to borrow more than they need or can afford. I can’t overstate the importance of establishing your financial literacy before borrowing student loans.

Emergencies: Lastly, unforeseen circumstances or unexpected expenses can prompt students to borrow additional loans, quickly compounding your debt balance if not managed responsibly.

How Much Can I Borrow?

It’s true that you can take out more student loan debt than you need in some cases, but should you? Student loans are a gateway to receiving your college degree, but you want to make sure your loans are manageable.

Fortunately for your future, financially savvy self, there is a limit to how much you can borrow. Your limit for federal loans depends on a few things: whether you can be claimed as a dependent, your current year in school, and the type of loan you take out.

As of 2024, undergraduates can borrow a maximum of $5,500 to $12,500 each year, or a total of $57,500. Graduate students can borrow up to $20,500 each year, or $138,500 in total (including undergraduate loans). How much you can borrow depends on your status (dependent or independent student), year of school, and the school’s cost of attendance.

You cannot borrow any type of qualified education loan beyond the cost of attendance.

See a full breakdown of the student loan borrowing limits here.

The maximum amount available to borrow through private student loans varies by lender, and you may even be able to borrow the amount that matches your cost of attendance. But, again, borrowing the maximum amount available to you isn’t often the best choice, mostly because student loan debt poses significant financial responsibility until it is paid off.

Remember, while subsidized loans include specific agreements – like where the US Department of Education pays interest on your loans while you’re in school and for the first six months after leaving school – direct loans start accruing interest when they’re disbursed. Either way, you’ll want to factor in this additional cost over the life of the loan.

Related: How To Take Out A Student Loan (Federal And Private)

Consequences Of Excessive Student Loan Debt

Excessive student loan debt can cause undue stress for borrowers well after graduation. It’s worth discussing those impacts ahead of time, so you have an idea of how your financial well-being may be altered down the road. Hopefully, understanding these unintended consequences before they occur will help you make informed borrowing decisions now.

Here are common side effects of excessive student loan debt:

Financial Strain: The most obvious consequence of having high student loan debt is the financial strain it creates. Having a high monthly payment quickly eats away at your total purchasing power, and it can become difficult to meet other financial obligations. Of course, the interest accrued on loans often means borrowers pay back far more than the amount they originally received, which can further stunt your progress toward other financial goals.

Delayed Milestones: Most of us have other life goals beyond school and work, including getting married, starting a family, or owning a home. But high debt payments can pose challenges to building up savings, covering wedding expenses, or affording the down payment on a home.

Financial Health: Unfortunately, missed or late loan payments can damage a borrower’s credit score overnight. Having a low credit score in the US signals to lenders that you are a riskier borrower, which makes it more difficult to obtain new loans, credit cards, or even favorable interest rates.

Mental and Emotional Stress: Any one of the items above is enough to take a toll on your mental and emotional well-being. Combined, the stress and anxiety of managing excessive debt can feel overwhelming.

Limited Post-Grad Opportunities: Less critical but nonetheless important to be aware of, having high levels of undergraduate loan debt may deter you from pursuing new post-grad opportunities. A common feeling here is the pressure to prioritize higher-paying jobs over other goals or positions you’re interested in.

How To Avoid Borrowing More Than You Need

The prospect of student loan debt can be daunting, but there are several strategies to keep in mind that will help reduce your total borrowing amount and allow you to make informed financial decisions. It all begins with planning for what you’ll actually need.

Writing out your budget is the first step to responsibly managing your expenses and avoiding excessive borrowing. Carefully track your expected income and expenses each year to identify how much you’ll need to cover the necessities. Then, find areas where you can cut costs to prioritize spending on education essentials. Consider downloading a budget app on your phone to help track your goals and spending.

Next, try to maximize your financial aid package by taking advantage of all options available to you. That includes applying for federal aid, grants, scholarships, and other tuition assistance programs offered by your university, employer, or a community organization.

For example, several small banks offer scholarships to local applicants. Receiving even an additional $2,500 reduces your total debt burden.

Another common tactic to reduce loan debt is finding part-time employment or enrolling in a work-study program. Any added income will offset the overall financial burden to you – and you’ll gain valuable job experience along the way.

Lastly, make sure you’re borrowing responsibly. Before accepting any loan offer, read through the terms and conditions, paying special attention the interest rates, repayment plans, and loan forgiveness options. You can go a step further by estimating your future earning potential and your ability to repay loans after graduation. But, most importantly, determine what you absolutely need to borrow to meet your needs right now, and try to refrain from accepting anything more than that.

The Takeaway

Student loan debt is a complex and highly personal topic. Receiving the financial means to pursue higher education has far-reaching implications for your personal growth, career advancement, and lifelong success. At the same time, accepting excessive student loans can have unintended consequences on your future goals, health, and financial well-being.

With college tuition on the rise, it’s extremely important that you understand the basics of student loan agreements, make informed decisions, and actively manage your loan debt. Prioritizing financial literacy, maximizing financial aid, and seeking alternative financing options are three ways to minimize the impacts of student loan debt after graduation.

And, above all, don’t forget to plan for the future! Your future self will thank you.